Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

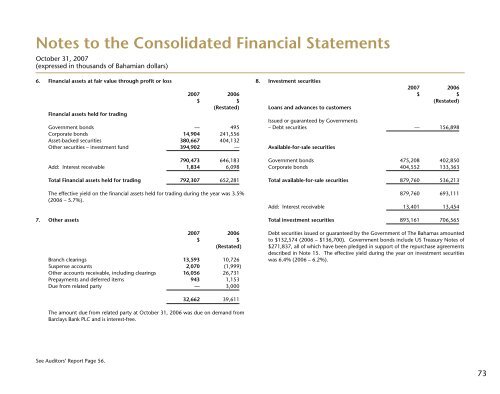

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

6. Financial assets at fair value through profit or loss<br />

Financial assets held for trading<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Government bonds — 495<br />

Corporate bonds 14,904 241,556<br />

Asset-backed securities 380,667 404,132<br />

Other securities – investment fund 394,902 —<br />

790,473 646,183<br />

Add: Interest receivable 1,834 6,098<br />

Total Financial assets held for trading 792,307 652,281<br />

The effective yield on the financial assets held for trading during the year was 3.5%<br />

(2006 – 5.7%).<br />

7. Other assets<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Branch clearings 13,593 10,726<br />

Suspense accounts 2,070 (1,999)<br />

Other accounts receivable, including clearings 16,056 26,731<br />

Prepayments and deferred items 943 1,153<br />

Due from related party — 3,000<br />

8. Investment securities<br />

Loans and advances to customers<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Issued or guaranteed by Governments<br />

– Debt securities — 156,898<br />

Available-for-sale securities<br />

Government bonds 475,208 402,850<br />

Corporate bonds 404,552 133,363<br />

Total available-for-sale securities 879,760 536,213<br />

879,760 693,111<br />

Add: Interest receivable 13,401 13,454<br />

Total investment securities 893,161 706,565<br />

Debt securities issued or guaranteed by the Government of The <strong>Bahamas</strong> amounted<br />

to $132,574 (2006 – $136,700). Government bonds include US Treasury Notes of<br />

$271,837, all of which have been pledged in support of the repurchase agreements<br />

described in Note 15. The effective yield during the year on investment securities<br />

was 6.4% (2006 – 6.2%).<br />

32,662 39,611<br />

The amount due from related party at October 31, 2006 was due on demand from<br />

Barclays <strong>Bank</strong> PLC and is interest-free.<br />

See Auditors’ Report Page 56.<br />

73