Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

28. Financial risk management (continued)<br />

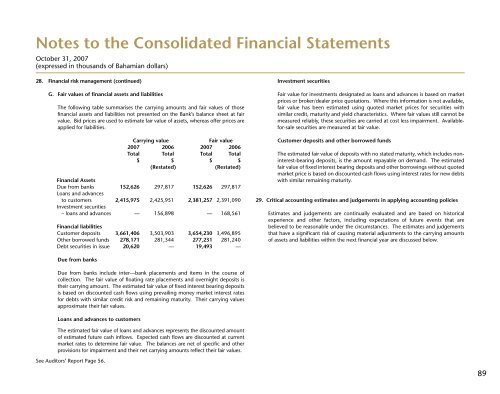

G. Fair values of financial assets and liabilities<br />

The following table summarises the carrying amounts and fair values of those<br />

financial assets and liabilities not presented on the <strong>Bank</strong>’s balance sheet at fair<br />

value. Bid prices are used to estimate fair value of assets, whereas offer prices are<br />

applied for liabilities.<br />

Carrying value<br />

Fair value<br />

2007 2006 2007 2006<br />

Total Total Total Total<br />

$ $ $ $<br />

(Restated)<br />

(Restated)<br />

Financial Assets<br />

Due from banks 152,626 297,817 152,626 297,817<br />

Loans and advances<br />

to customers 2,415,975 2,425,951 2,381,257 2,391,090<br />

Investment securities<br />

– loans and advances — 156,898 — 168,561<br />

Financial liabilities<br />

Customer deposits 3,661,406 3,503,903 3,654,230 3,496,895<br />

Other borrowed funds 278,171 281,344 277,231 281,240<br />

Debt securities in issue 20,620 — 19,493 —<br />

Investment securities<br />

Fair value for investments designated as loans and advances is based on market<br />

prices or broker/dealer price quotations. Where this information is not available,<br />

fair value has been estimated using quoted market prices for securities with<br />

similar credit, maturity and yield characteristics. Where fair values still cannot be<br />

measured reliably, these securities are carried at cost less impairment. Availablefor-sale<br />

securities are measured at fair value.<br />

Customer deposits and other borrowed funds<br />

The estimated fair value of deposits with no stated maturity, which includes noninterest-bearing<br />

deposits, is the amount repayable on demand. The estimated<br />

fair value of fixed interest bearing deposits and other borrowings without quoted<br />

market price is based on discounted cash flows using interest rates for new debts<br />

with similar remaining maturity.<br />

29. Critical accounting estimates and judgements in applying accounting policies<br />

Estimates and judgements are continually evaluated and are based on historical<br />

experience and other factors, including expectations of future events that are<br />

believed to be reasonable under the circumstances. The estimates and judgements<br />

that have a significant risk of causing material adjustments to the carrying amounts<br />

of assets and liabilities within the next financial year are discussed below.<br />

Due from banks<br />

Due from banks include inter—bank placements and items in the course of<br />

collection. The fair value of floating rate placements and overnight deposits is<br />

their carrying amount. The estimated fair value of fixed interest bearing deposits<br />

is based on discounted cash flows using prevailing money market interest rates<br />

for debts with similar credit risk and remaining maturity. Their carrying values<br />

approximate their fair values.<br />

Loans and advances to customers<br />

The estimated fair value of loans and advances represents the discounted amount<br />

of estimated future cash inflows. Expected cash flows are discounted at current<br />

market rates to determine fair value. The balances are net of specific and other<br />

provisions for impairment and their net carrying amounts reflect their fair values.<br />

See Auditors’ Report Page 56.<br />

89