ICT and e-business in the tourism industry ICT adoption ... - empirica

ICT and e-business in the tourism industry ICT adoption ... - empirica

ICT and e-business in the tourism industry ICT adoption ... - empirica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Tourism<br />

Currently, IATA members process about 300 million paper tickets each year. Based on<br />

<strong>the</strong>se figures, it is estimated that <strong>the</strong> 100% e-ticket<strong>in</strong>g will save <strong>the</strong> <strong>in</strong>dustry up to 3 billion<br />

US dollars per year. e-Ticket<strong>in</strong>g cost sav<strong>in</strong>gs will derive from <strong>the</strong> elim<strong>in</strong>ation of pr<strong>in</strong>t<strong>in</strong>g,<br />

postage, shipp<strong>in</strong>g, storage <strong>and</strong> account<strong>in</strong>g costs; costs for collateral materials like<br />

envelopes <strong>and</strong> ticket jackets, <strong>in</strong>creased efficiency <strong>in</strong> revenue account<strong>in</strong>g; <strong>and</strong> last but not<br />

least, a reduction <strong>in</strong> space necessary for airport counters by <strong>in</strong>creas<strong>in</strong>g <strong>the</strong> use of selfservice<br />

check-<strong>in</strong> (cf. www.iata.org).<br />

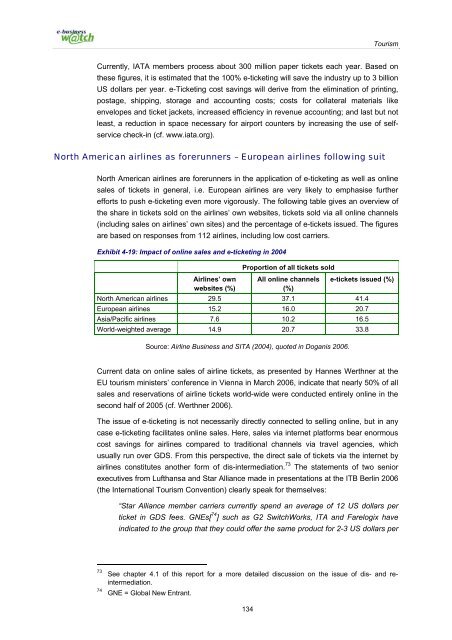

North American airl<strong>in</strong>es as forerunners – European airl<strong>in</strong>es follow<strong>in</strong>g suit<br />

North American airl<strong>in</strong>es are forerunners <strong>in</strong> <strong>the</strong> application of e-ticket<strong>in</strong>g as well as onl<strong>in</strong>e<br />

sales of tickets <strong>in</strong> general, i.e. European airl<strong>in</strong>es are very likely to emphasise fur<strong>the</strong>r<br />

efforts to push e-ticket<strong>in</strong>g even more vigorously. The follow<strong>in</strong>g table gives an overview of<br />

<strong>the</strong> share <strong>in</strong> tickets sold on <strong>the</strong> airl<strong>in</strong>es’ own websites, tickets sold via all onl<strong>in</strong>e channels<br />

(<strong>in</strong>clud<strong>in</strong>g sales on airl<strong>in</strong>es’ own sites) <strong>and</strong> <strong>the</strong> percentage of e-tickets issued. The figures<br />

are based on responses from 112 airl<strong>in</strong>es, <strong>in</strong>clud<strong>in</strong>g low cost carriers.<br />

Exhibit 4-19: Impact of onl<strong>in</strong>e sales <strong>and</strong> e-ticket<strong>in</strong>g <strong>in</strong> 2004<br />

Airl<strong>in</strong>es’ own<br />

websites (%)<br />

Proportion of all tickets sold<br />

All onl<strong>in</strong>e channels<br />

(%)<br />

e-tickets issued (%)<br />

North American airl<strong>in</strong>es 29.5 37.1 41.4<br />

European airl<strong>in</strong>es 15.2 16.0 20.7<br />

Asia/Pacific airl<strong>in</strong>es 7.6 10.2 16.5<br />

World-weighted average 14.9 20.7 33.8<br />

Source: Airl<strong>in</strong>e Bus<strong>in</strong>ess <strong>and</strong> SITA (2004), quoted <strong>in</strong> Doganis 2006.<br />

Current data on onl<strong>in</strong>e sales of airl<strong>in</strong>e tickets, as presented by Hannes Werthner at <strong>the</strong><br />

EU <strong>tourism</strong> m<strong>in</strong>isters’ conference <strong>in</strong> Vienna <strong>in</strong> March 2006, <strong>in</strong>dicate that nearly 50% of all<br />

sales <strong>and</strong> reservations of airl<strong>in</strong>e tickets world-wide were conducted entirely onl<strong>in</strong>e <strong>in</strong> <strong>the</strong><br />

second half of 2005 (cf. Werthner 2006).<br />

The issue of e-ticket<strong>in</strong>g is not necessarily directly connected to sell<strong>in</strong>g onl<strong>in</strong>e, but <strong>in</strong> any<br />

case e-ticket<strong>in</strong>g facilitates onl<strong>in</strong>e sales. Here, sales via <strong>in</strong>ternet platforms bear enormous<br />

cost sav<strong>in</strong>gs for airl<strong>in</strong>es compared to traditional channels via travel agencies, which<br />

usually run over GDS. From this perspective, <strong>the</strong> direct sale of tickets via <strong>the</strong> <strong>in</strong>ternet by<br />

airl<strong>in</strong>es constitutes ano<strong>the</strong>r form of dis-<strong>in</strong>termediation. 73 The statements of two senior<br />

executives from Lufthansa <strong>and</strong> Star Alliance made <strong>in</strong> presentations at <strong>the</strong> ITB Berl<strong>in</strong> 2006<br />

(<strong>the</strong> International Tourism Convention) clearly speak for <strong>the</strong>mselves:<br />

“Star Alliance member carriers currently spend an average of 12 US dollars per<br />

ticket <strong>in</strong> GDS fees. GNEs[ 74 ] such as G2 SwitchWorks, ITA <strong>and</strong> Farelogix have<br />

<strong>in</strong>dicated to <strong>the</strong> group that <strong>the</strong>y could offer <strong>the</strong> same product for 2-3 US dollars per<br />

73<br />

74<br />

See chapter 4.1 of this report for a more detailed discussion on <strong>the</strong> issue of dis- <strong>and</strong> re<strong>in</strong>termediation.<br />

GNE = Global New Entrant.<br />

134