ICT and e-business in the tourism industry ICT adoption ... - empirica

ICT and e-business in the tourism industry ICT adoption ... - empirica

ICT and e-business in the tourism industry ICT adoption ... - empirica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Tourism<br />

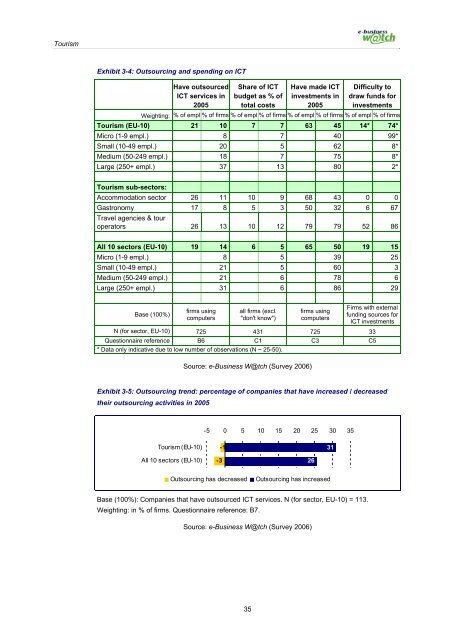

Exhibit 3-4: Outsourc<strong>in</strong>g <strong>and</strong> spend<strong>in</strong>g on <strong>ICT</strong><br />

Have outsourced<br />

<strong>ICT</strong> services <strong>in</strong><br />

2005<br />

Share of <strong>ICT</strong><br />

budget as % of<br />

total costs<br />

Have made <strong>ICT</strong><br />

<strong>in</strong>vestments <strong>in</strong><br />

2005<br />

Difficulty to<br />

draw funds for<br />

<strong>in</strong>vestments<br />

Weight<strong>in</strong>g: % of empl % of firms % of empl % of firms % of empl % of firms % of empl % of firms<br />

Tourism (EU-10) 21 10 7 7 63 45 14* 74*<br />

Micro (1-9 empl.) 8 7 40 99*<br />

Small (10-49 empl.) 20 5 62 8*<br />

Medium (50-249 empl.) 18 7 75 8*<br />

Large (250+ empl.) 37 13 80 2*<br />

Tourism sub-sectors:<br />

Accommodation sector 26 11 10 9 68 43 0 0<br />

Gastronomy 17 8 5 3 50 32 6 67<br />

Travel agencies & tour<br />

operators 26 13 10 12 79 79 52 86<br />

All 10 sectors (EU-10) 19 14 6 5 65 50 19 15<br />

Micro (1-9 empl.) 8 5 39 25<br />

Small (10-49 empl.) 21 5 60 3<br />

Medium (50-249 empl.) 21 6 78 6<br />

Large (250+ empl.) 31 6 86 29<br />

Base (100%)<br />

firms us<strong>in</strong>g<br />

computers<br />

all firms (excl.<br />

"don't know")<br />

firms us<strong>in</strong>g<br />

computers<br />

Firms with external<br />

fund<strong>in</strong>g sources for<br />

<strong>ICT</strong> <strong>in</strong>vestments<br />

N (for sector, EU-10) 725 431 725 33<br />

Questionnaire reference B6 C1 C3 C5<br />

* Data only <strong>in</strong>dicative due to low number of observations (N ~ 25-50).<br />

Source: e-Bus<strong>in</strong>ess W@tch (Survey 2006)<br />

Exhibit 3-5: Outsourc<strong>in</strong>g trend: percentage of companies that have <strong>in</strong>creased / decreased<br />

<strong>the</strong>ir outsourc<strong>in</strong>g activities <strong>in</strong> 2005<br />

-5 0 5 10 15 20 25 30 35<br />

Tourism (EU-10)<br />

All 10 sectors (EU-10)<br />

-1<br />

-3 26<br />

31<br />

Outsourc<strong>in</strong>g has decreased<br />

Outsourc<strong>in</strong>g has <strong>in</strong>creased<br />

Base (100%): Companies that have outsourced <strong>ICT</strong> services. N (for sector, EU-10) = 113.<br />

Weight<strong>in</strong>g: <strong>in</strong> % of firms. Questionnaire reference: B7.<br />

Source: e-Bus<strong>in</strong>ess W@tch (Survey 2006)<br />

35