The Palestinian Economy. Theoretical and Practical Challenges

The Palestinian Economy. Theoretical and Practical Challenges

The Palestinian Economy. Theoretical and Practical Challenges

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Proceedings “<strong>The</strong> <strong>Palestinian</strong> <strong>Economy</strong>: <strong>The</strong>oretical <strong>and</strong> <strong>Practical</strong> <strong>Challenges</strong>” 297<br />

1. <strong>The</strong> <strong>Palestinian</strong> credit market: institutional background<br />

Before going deeper into the analysis of the aims, efficiency <strong>and</strong> effectiveness of<br />

<strong>Palestinian</strong> micro credit, a rapid overview of the main institutional characteristic of the<br />

credit market is in order.<br />

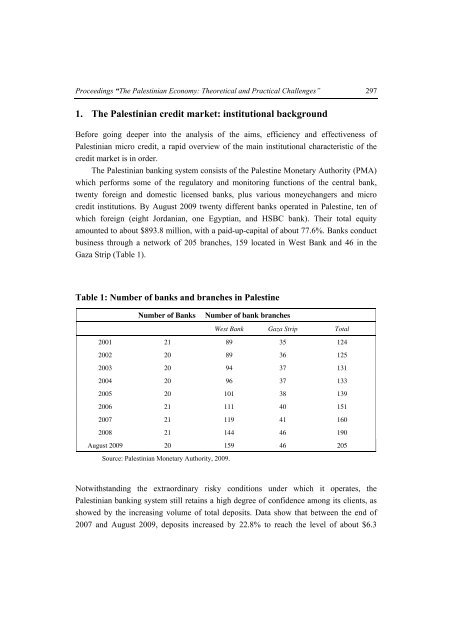

<strong>The</strong> <strong>Palestinian</strong> banking system consists of the Palestine Monetary Authority (PMA)<br />

which performs some of the regulatory <strong>and</strong> monitoring functions of the central bank,<br />

twenty foreign <strong>and</strong> domestic licensed banks, plus various moneychangers <strong>and</strong> micro<br />

credit institutions. By August 2009 twenty different banks operated in Palestine, ten of<br />

which foreign (eight Jordanian, one Egyptian, <strong>and</strong> HSBC bank). <strong>The</strong>ir total equity<br />

amounted to about $893.8 million, with a paid-up-capital of about 77.6%. Banks conduct<br />

business through a network of 205 branches, 159 located in West Bank <strong>and</strong> 46 in the<br />

Gaza Strip (Table 1).<br />

Table 1: Number of banks <strong>and</strong> branches in Palestine<br />

Number of Banks Number of bank branches<br />

West Bank Gaza Strip Total<br />

2001 21 89 35 124<br />

2002 20 89 36 125<br />

2003 20 94 37 131<br />

2004 20 96 37 133<br />

2005 20 101 38 139<br />

2006 21 111 40 151<br />

2007 21 119 41 160<br />

2008 21 144 46 190<br />

August 2009 20 159 46 205<br />

Source: <strong>Palestinian</strong> Monetary Authority, 2009.<br />

Notwithst<strong>and</strong>ing the extraordinary risky conditions under which it operates, the<br />

<strong>Palestinian</strong> banking system still retains a high degree of confidence among its clients, as<br />

showed by the increasing volume of total deposits. Data show that between the end of<br />

2007 <strong>and</strong> August 2009, deposits increased by 22.8% to reach the level of about $6.3