The Palestinian Economy. Theoretical and Practical Challenges

The Palestinian Economy. Theoretical and Practical Challenges

The Palestinian Economy. Theoretical and Practical Challenges

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Proceedings “<strong>The</strong> <strong>Palestinian</strong> <strong>Economy</strong>: <strong>The</strong>oretical <strong>and</strong> <strong>Practical</strong> <strong>Challenges</strong>” 301<br />

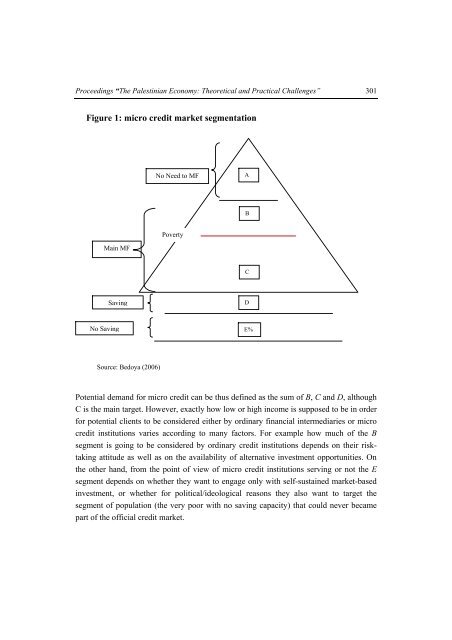

Figure 1: micro credit market segmentation<br />

No Need to MF<br />

A<br />

B<br />

Poverty<br />

Main MF<br />

C<br />

Saving<br />

D<br />

No Saving E%<br />

Source: Bedoya (2006)<br />

Potential dem<strong>and</strong> for micro credit can be thus defined as the sum of B, C <strong>and</strong> D, although<br />

C is the main target. However, exactly how low or high income is supposed to be in order<br />

for potential clients to be considered either by ordinary financial intermediaries or micro<br />

credit institutions varies according to many factors. For example how much of the B<br />

segment is going to be considered by ordinary credit institutions depends on their risktaking<br />

attitude as well as on the availability of alternative investment opportunities. On<br />

the other h<strong>and</strong>, from the point of view of micro credit institutions serving or not the E<br />

segment depends on whether they want to engage only with self-sustained market-based<br />

investment, or whether for political/ideological reasons they also want to target the<br />

segment of population (the very poor with no saving capacity) that could never became<br />

part of the official credit market.