Deciding the Future: Energy Policy Scenarios to 2050

Deciding the Future: Energy Policy Scenarios to 2050

Deciding the Future: Energy Policy Scenarios to 2050

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

92<br />

<strong>Deciding</strong> <strong>the</strong> <strong>Future</strong>: <strong>Energy</strong> <strong>Policy</strong> <strong>Scenarios</strong> <strong>to</strong> <strong>2050</strong> World <strong>Energy</strong> Council 2007 Appendices<br />

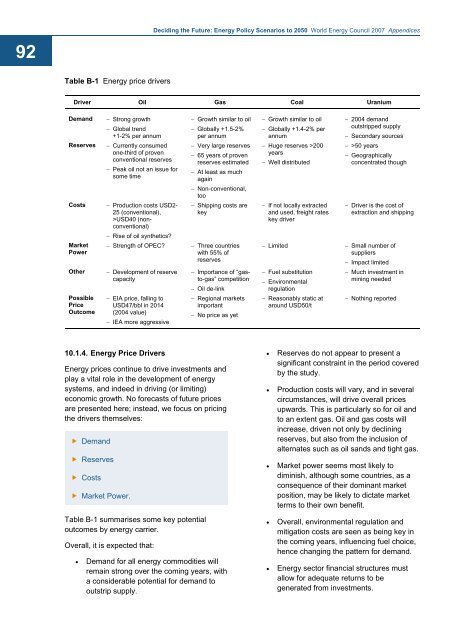

Table B-1 <strong>Energy</strong> price drivers<br />

Driver Oil Gas Coal Uranium<br />

Demand<br />

Reserves<br />

Costs<br />

Market<br />

Power<br />

O<strong>the</strong>r<br />

Possible<br />

Price<br />

Outcome<br />

− Strong growth<br />

− Global trend<br />

+1-2% per annum<br />

− Currently consumed<br />

one-third of proven<br />

conventional reserves<br />

− Peak oil not an issue for<br />

some time<br />

− Production costs USD2-<br />

25 (conventional),<br />

>USD40 (nonconventional)<br />

− Rise of oil syn<strong>the</strong>tics?<br />

− Strength of OPEC?<br />

− Development of reserve<br />

capacity<br />

− EIA price, falling <strong>to</strong><br />

USD47/bbl in 2014<br />

(2004 value)<br />

− IEA more aggressive<br />

− Growth similar <strong>to</strong> oil<br />

− Globally +1.5-2%<br />

per annum<br />

− Very large reserves<br />

− 65 years of proven<br />

reserves estimated<br />

− At least as much<br />

again<br />

− Non-conventional,<br />

<strong>to</strong>o<br />

− Shipping costs are<br />

key<br />

− Three countries<br />

with 55% of<br />

reserves<br />

− Importance of “gas<strong>to</strong>-gas”<br />

competition<br />

− Oil de-link<br />

− Regional markets<br />

important<br />

− No price as yet<br />

− Growth similar <strong>to</strong> oil<br />

− Globally +1.4-2% per<br />

annum<br />

− Huge reserves >200<br />

years<br />

− Well distributed<br />

− If not locally extracted<br />

and used, freight rates<br />

key driver<br />

− Limited<br />

− Fuel substitution<br />

− Environmental<br />

regulation<br />

− Reasonably static at<br />

around USD50/t<br />

− 2004 demand<br />

outstripped supply<br />

− Secondary sources<br />

− >50 years<br />

− Geographically<br />

concentrated though<br />

− Driver is <strong>the</strong> cost of<br />

extraction and shipping<br />

− Small number of<br />

suppliers<br />

− Impact limited<br />

− Much investment in<br />

mining needed<br />

− Nothing reported<br />

10.1.4. <strong>Energy</strong> Price Drivers<br />

<strong>Energy</strong> prices continue <strong>to</strong> drive investments and<br />

play a vital role in <strong>the</strong> development of energy<br />

systems, and indeed in driving (or limiting)<br />

economic growth. No forecasts of future prices<br />

are presented here; instead, we focus on pricing<br />

<strong>the</strong> drivers <strong>the</strong>mselves:<br />

Demand<br />

Reserves<br />

Costs<br />

Market Power.<br />

Table B-1 summarises some key potential<br />

outcomes by energy carrier.<br />

Overall, it is expected that:<br />

• Demand for all energy commodities will<br />

remain strong over <strong>the</strong> coming years, with<br />

a considerable potential for demand <strong>to</strong><br />

outstrip supply.<br />

• Reserves do not appear <strong>to</strong> present a<br />

significant constraint in <strong>the</strong> period covered<br />

by <strong>the</strong> study.<br />

• Production costs will vary, and in several<br />

circumstances, will drive overall prices<br />

upwards. This is particularly so for oil and<br />

<strong>to</strong> an extent gas. Oil and gas costs will<br />

increase, driven not only by declining<br />

reserves, but also from <strong>the</strong> inclusion of<br />

alternates such as oil sands and tight gas.<br />

• Market power seems most likely <strong>to</strong><br />

diminish, although some countries, as a<br />

consequence of <strong>the</strong>ir dominant market<br />

position, may be likely <strong>to</strong> dictate market<br />

terms <strong>to</strong> <strong>the</strong>ir own benefit.<br />

• Overall, environmental regulation and<br />

mitigation costs are seen as being key in<br />

<strong>the</strong> coming years, influencing fuel choice,<br />

hence changing <strong>the</strong> pattern for demand.<br />

• <strong>Energy</strong> sec<strong>to</strong>r financial structures must<br />

allow for adequate returns <strong>to</strong> be<br />

generated from investments.