Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Part 3 - Financial statements<br />

103<br />

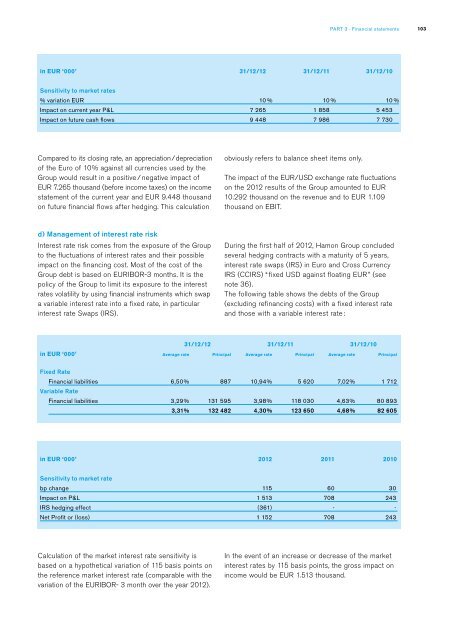

in EUR ‘000’ 31/12/12 31/12/11 31/12/10<br />

Sensitivity to market rates<br />

% variation EUR 10 % 10 % 10 %<br />

Impact on current year P&L 7 265 1 858 5 453<br />

Impact on future cash flows 9 448 7 986 7 730<br />

Compared to its closing rate, an appreciation / depreciation<br />

of the Euro of 10% against all currencies used by the<br />

Group would result in a positive / negative impact of<br />

EUR 7.265 thousand (before income taxes) on the income<br />

statement of the current year and EUR 9.448 thousand<br />

on future financial flows after hedging. This calculation<br />

obviously refers to balance sheet items only.<br />

The impact of the EUR/USD exchange rate fluctuations<br />

on the 2012 results of the Group amounted to EUR<br />

10.292 thousand on the revenue and to EUR 1.109<br />

thousand on EBIT.<br />

d) Management of interest rate risk<br />

Interest rate risk comes from the exposure of the Group<br />

to the fluctuations of interest rates and their possible<br />

impact on the financing cost. Most of the cost of the<br />

Group debt is based on EURIBOR-3 months. It is the<br />

policy of the Group to limit its exposure to the interest<br />

rates volatility by using financial instruments which swap<br />

a variable interest rate into a fixed rate, in particular<br />

interest rate Swaps (IRS).<br />

During the first half of 2012, <strong>Hamon</strong> Group concluded<br />

several hedging contracts with a maturity of 5 years,<br />

interest rate swaps (IRS) in Euro and Cross Currency<br />

IRS (CCIRS) “ fixed USD against floating EUR ” (see<br />

note 36).<br />

The following table shows the debts of the Group<br />

(excluding refinancing costs) with a fixed interest rate<br />

and those with a variable interest rate :<br />

31/12/12 31/12/11 31/12/10<br />

in EUR ‘000’ Average rate Principal Average rate Principal Average rate Principal<br />

Fixed Rate<br />

Financial liabilities 6,50% 887 10,94% 5 620 7,02% 1 712<br />

Variable Rate<br />

Financial liabilities 3,29% 131 595 3,98% 118 030 4,63% 80 893<br />

3,31% 132 482 4,30% 123 650 4,68% 82 605<br />

in EUR ‘000’ 2012 2011 2010<br />

Sensitivity to market rate<br />

bp change 115 60 30<br />

Impact on P&L 1 513 708 243<br />

IRS hedging effect (361) - -<br />

Net Profit or (loss) 1 152 708 243<br />

Calculation of the market interest rate sensitivity is<br />

based on a hypothetical variation of 115 basis points on<br />

the reference market interest rate (comparable with the<br />

variation of the EURIBOR- 3 month over the year 2012).<br />

In the event of an increase or decrease of the market<br />

interest rates by 115 basis points, the gross impact on<br />

income would be EUR 1.513 thousand.