Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Part 3 - Financial statements<br />

99<br />

Concerning financial covenants, this syndicated credit<br />

facility requires the compliance with the following ratios :<br />

Net Debt / EBITDA, EBITDA / Net Cash Interest Payable<br />

(minimum 2,50), Total Debt / Book Equity (maximum<br />

2,00) and limits the amount of capital expenditures<br />

(EUR 25 million per year).<br />

The Net Debt/EBITDA ratio should be lower than<br />

3,00 except as of 31 December 2012 (3,50) and as<br />

of 30 June 2013 (3,25).<br />

All those ratios are achieved by the Group.<br />

The financing margins of the “ revolverv” credit line vary<br />

between 1,1 % and 2,1 % depending on the Net Debt /<br />

EBITDA ratio.<br />

The Belgian treasury notes program signed on 30 August<br />

2010 with two dealers remains a real success among<br />

investors. The amount of treasury notes amounts to<br />

EUR 35.906 thousand as of 31 December 2012.<br />

The average cost of the debt was 3,31% for 2012,<br />

(4,30 % for 2011) or 3,92 % (5,46 % in 2011) if the<br />

amortized refinancing costs of the credit lines are<br />

included in the analysis.<br />

The debt of the <strong>Hamon</strong> Group – with the exception<br />

of leasing debts and treasury notes – uses variable<br />

interest rate references.<br />

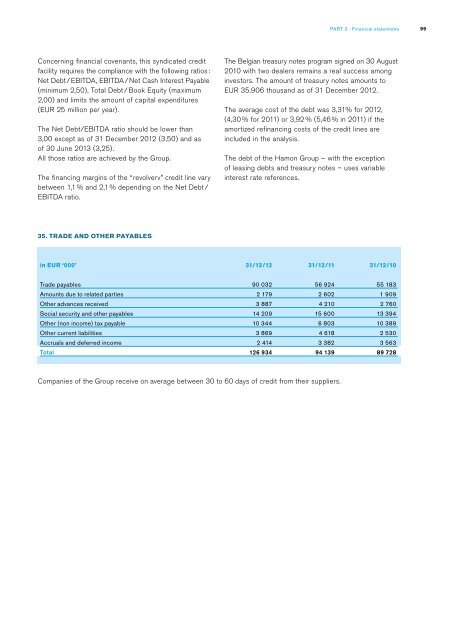

35. TRADE AND OTHER PAYABLES<br />

in EUR ‘000’ 31/12/12 31/12/11 31/12/10<br />

Trade payables 90 032 56 924 55 183<br />

Amounts due to related parties 2 179 2 602 1 909<br />

Other advances received 3 887 4 210 2 760<br />

Social security and other payables 14 209 15 600 13 394<br />

Other (non income) tax payable 10 344 6 803 10 389<br />

Other current liabilities 3 869 4 618 2 530<br />

Accruals and deferred income 2 414 3 382 3 563<br />

Total 126 934 94 139 89 728<br />

Companies of the Group receive on average between 30 to 60 days of credit from their suppliers.