Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

96<br />

<strong>Hamon</strong> Annual Report 2012<br />

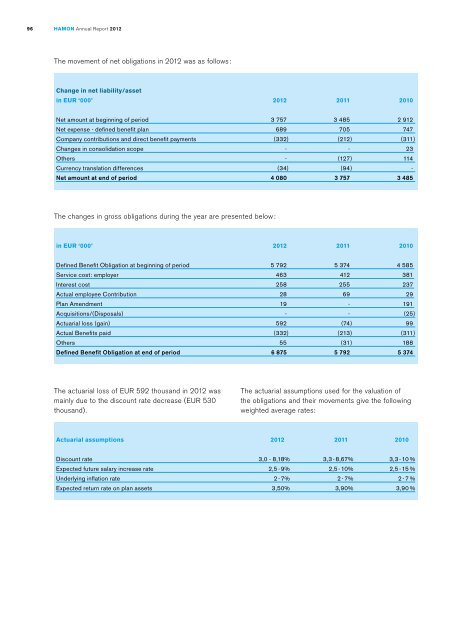

The movement of net obligations in 2012 was as follows :<br />

Change in net liability/asset<br />

in EUR ‘000’ 2012 2011 2010<br />

Net amount at beginning of period 3 757 3 485 2 912<br />

Net expense - defined benefit plan 689 705 747<br />

Company contributions and direct benefit payments (332) (212) (311 )<br />

Changes in consolidation scope - - 23<br />

Others - (127) 114<br />

Currency translation differences (34) (94) -<br />

Net amount at end of period 4 080 3 757 3 485<br />

The changes in gross obligations during the year are presented below :<br />

in EUR ‘000’ 2012 2011 2010<br />

Defined Benefit Obligation at beginning of period 5 792 5 374 4 585<br />

Service cost: employer 463 412 381<br />

Interest cost 258 255 237<br />

Actual employee Contribution 28 69 29<br />

Plan Amendment 19 - 191<br />

Acquisitions/(Disposals) - - (25)<br />

Actuarial loss (gain) 592 (74) 99<br />

Actual Benefits paid (332) (213) (311 )<br />

Others 55 (31) 188<br />

Defined Benefit Obligation at end of period 6 875 5 792 5 374<br />

The actuarial loss of EUR 592 thousand in 2012 was<br />

mainly due to the discount rate decrease (EUR 530<br />

thousand).<br />

The actuarial assumptions used for the valuation of<br />

the obligations and their movements give the following<br />

weighted average rates:<br />

Actuarial assumptions 2012 2011 2010<br />

Discount rate 3,0 - 8,18 % 3,3 - 8,67 % 3,3 - 10 %<br />

Expected future salary increase rate 2,5 - 9 % 2,5 - 10 % 2,5 - 15 %<br />

Underlying inflation rate 2 - 7 % 2 - 7 % 2 - 7 %<br />

Expected return rate on plan assets 3,50 % 3,90 % 3,90 %