Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Part 3 - Financial statements<br />

91<br />

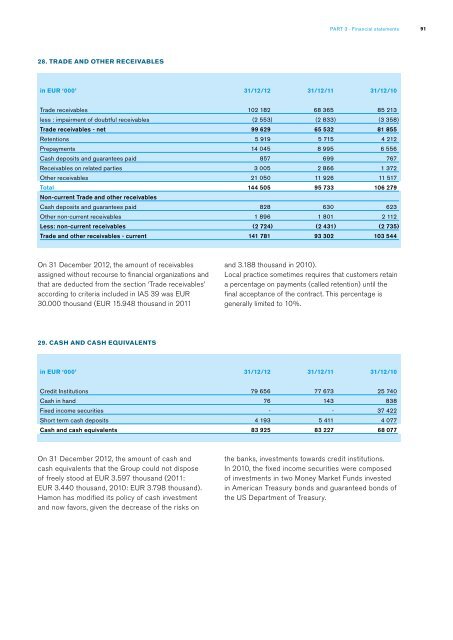

28. Trade and other receivables<br />

in EUR ‘000’ 31/12/12 31/12/11 31/12/10<br />

Trade receivables 102 182 68 365 85 213<br />

less : impairment of doubtful receivables (2 553 ) (2 833 ) (3 358 )<br />

Trade receivables - net 99 629 65 532 81 855<br />

Retentions 5 919 5 715 4 212<br />

Prepayments 14 045 8 995 6 556<br />

Cash deposits and guarantees paid 857 699 767<br />

Receivables on related parties 3 005 2 866 1 372<br />

Other receivables 21 050 11 926 11 517<br />

Total 144 505 95 733 106 279<br />

Non-current Trade and other receivables<br />

Cash deposits and guarantees paid 828 630 623<br />

Other non-current receivables 1 896 1 801 2 112<br />

Less: non-current receivables (2 724 ) (2 431 ) (2 735 )<br />

Trade and other receivables - current 141 781 93 302 103 544<br />

On 31 December 2012, the amount of receivables<br />

assigned without recourse to financial organizations and<br />

that are deducted from the section ‘Trade receivables’<br />

according to criteria included in IAS 39 was EUR<br />

30.000 thousand (EUR 15.948 thousand in 2011<br />

and 3.188 thousand in 2010).<br />

Local practice sometimes requires that customers retain<br />

a percentage on payments (called retention) until the<br />

final acceptance of the contract. This percentage is<br />

generally limited to 10%.<br />

29. Cash and cash equivalents<br />

in EUR ‘000’ 31/12/12 31/12/11 31/12/10<br />

Credit Institutions 79 656 77 673 25 740<br />

Cash in hand 76 143 838<br />

Fixed income securities - - 37 422<br />

Short term cash deposits 4 193 5 411 4 077<br />

Cash and cash equivalents 83 925 83 227 68 077<br />

On 31 December 2012, the amount of cash and<br />

cash equivalents that the Group could not dispose<br />

of freely stood at EUR 3.597 thousand (2011:<br />

EUR 3.440 thousand, 2010: EUR 3.798 thousand).<br />

<strong>Hamon</strong> has modified its policy of cash investment<br />

and now favors, given the decrease of the risks on<br />

the banks, investments towards credit institutions.<br />

In 2010, the fixed income securities were composed<br />

of investments in two Money Market Funds invested<br />

in American Treasury bonds and guaranteed bonds of<br />

the US Department of Treasury.