Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

98<br />

<strong>Hamon</strong> Annual Report 2012<br />

Volatility is based on historical volatilities on 50 and<br />

500 days.<br />

Taking into account the exercise price and the charges<br />

of the initial values accounted for in income statement,<br />

the stock option plan represents a cost of EUR 0<br />

thousand (EUR 29 thousand in 2011 and EUR 45<br />

thousand in 2010) calculated according to the<br />

Black & Scholes model.<br />

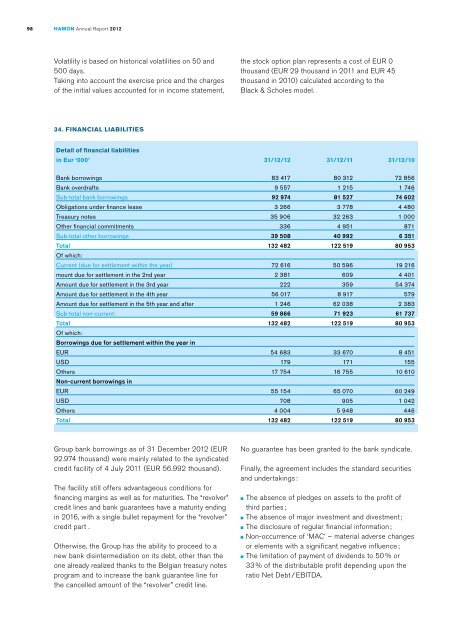

34. FINANCIAL LIABILITIES<br />

Detail of financial liabilities<br />

in Eur ‘000’ 31/12/12 31/12/11 31/12/10<br />

Bank borrowings 83 417 80 312 72 856<br />

Bank overdrafts 9 557 1 215 1 746<br />

Sub-total bank borrowings 92 974 81 527 74 602<br />

Obligations under finance lease 3 266 3 778 4 480<br />

Treasury notes 35 906 32 263 1 000<br />

Other financial commitments 336 4 951 871<br />

Sub-total other borrowings 39 508 40 992 6 351<br />

Total 132 482 122 519 80 953<br />

Of which:<br />

Current (due for settlement within the year) 72 616 50 596 19 216<br />

mount due for settlement in the 2nd year 2 381 609 4 401<br />

Amount due for settlement in the 3rd year 222 359 54 374<br />

Amount due for settlement in the 4th year 56 017 8 917 579<br />

Amount due for settlement in the 5th year and after 1 246 62 038 2 383<br />

Sub-total non-current: 59 866 71 923 61 737<br />

Total 132 482 122 519 80 953<br />

Of which:<br />

Borrowings due for settlement within the year in<br />

EUR 54 683 33 670 8 451<br />

USD 179 171 155<br />

Others 17 754 16 755 10 610<br />

Non-current borrowings in<br />

EUR 55 154 65 070 60 249<br />

USD 708 905 1 042<br />

Others 4 004 5 948 446<br />

Total 132 482 122 519 80 953<br />

Group bank borrowings as of 31 December 2012 (EUR<br />

92.974 thousand) were mainly related to the syndicated<br />

credit facility of 4 July 2011 (EUR 56.992 thousand).<br />

The facility still offers advantageous conditions for<br />

financing margins as well as for maturities. The “revolver”<br />

credit lines and bank guarantees have a maturity ending<br />

in 2016, with a single bullet repayment for the “revolver”<br />

credit part .<br />

Otherwise, the Group has the ability to proceed to a<br />

new bank disintermediation on its debt, other than the<br />

one already realized thanks to the Belgian treasury notes<br />

program and to increase the bank guarantee line for<br />

the cancelled amount of the “revolver” credit line.<br />

No guarantee has been granted to the bank syndicate.<br />

Finally, the agreement includes the standard securities<br />

and undertakings :<br />

■ The absence of pledges on assets to the profit of<br />

third parties ;<br />

■ The absence of major investment and divestment ;<br />

■ The disclosure of regular financial information ;<br />

■ Non-occurrence of ‘MAC’ – material adverse changes<br />

or elements with a significant negative influence ;<br />

■ The limitation of payment of dividends to 50 % or<br />

33 % of the distributable profit depending upon the<br />

ratio Net Debt / EBITDA.