Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

78<br />

<strong>Hamon</strong> Annual Report 2012<br />

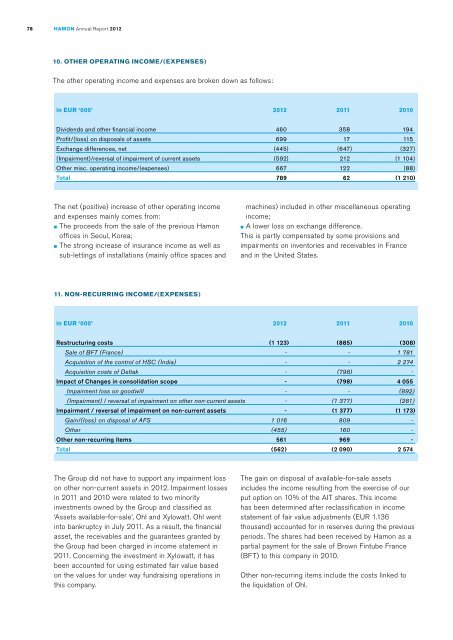

10. Other operating income/(expenses)<br />

The other operating income and expenses are broken down as follows:<br />

in EUR ‘000’<br />

2012 2011 2010<br />

Dividends and other financial income<br />

Profit/(loss) on disposals of assets<br />

Exchange differences, net<br />

(Impairment)/reversal of impairment of current assets<br />

Other misc. operating income/(expenses)<br />

Total<br />

460 358 194<br />

699 17 115<br />

(445) (647) (327)<br />

(592) 212 (1 104 )<br />

667 122 (88)<br />

789 62 (1 210 )<br />

The net (positive) increase of other operating income<br />

and expenses mainly comes from:<br />

■ The proceeds from the sale of the previous <strong>Hamon</strong><br />

offices in Seoul, Korea;<br />

■ The strong increase of insurance income as well as<br />

sub-lettings of installations (mainly office spaces and<br />

machines) included in other miscellaneous operating<br />

income;<br />

■ A lower loss on exchange difference.<br />

This is partly compensated by some provisions and<br />

impairments on inventories and receivables in France<br />

and in the United States.<br />

11. Non-recurring income/(expenses)<br />

in EUR ‘000’<br />

2012 2011 2010<br />

Restructuring costs<br />

Sale of BFT (France)<br />

Acquisition of the control of HSC (India)<br />

Acquisition costs of Deltak<br />

Impact of Changes in consolidation scope<br />

Impairment loss on goodwill<br />

(Impairment) / reversal of impairment on other non-current assets<br />

Impairment / reversal of impairment on non-current assets<br />

Gain/(loss) on disposal of AFS<br />

Other<br />

Other non-recurring items<br />

Total<br />

(1 123 ) (885) (308)<br />

- - 1 781<br />

- - 2 274<br />

- (798) -<br />

- (798) 4 055<br />

- - (892)<br />

- (1 377 ) (281)<br />

- (1 377 ) (1 173 )<br />

1 016 809 -<br />

(455) 160 -<br />

561 969 -<br />

(562) (2 090 ) 2 574<br />

The Group did not have to support any impairment loss<br />

on other non-current assets in 2012. Impairment losses<br />

in 2011 and 2010 were related to two minority<br />

investments owned by the Group and classified as<br />

‘Assets available-for-sale’, Ohl and Xylowatt. Ohl went<br />

into bankruptcy in July 2011. As a result, the financial<br />

asset, the receivables and the guarantees granted by<br />

the Group had been charged in income statement in<br />

2011. Concerning the investment in Xylowatt, it has<br />

been accounted for using estimated fair value based<br />

on the values for under way fundraising operations in<br />

this company.<br />

The gain on disposal of available-for-sale assets<br />

includes the income resulting from the exercise of our<br />

put option on 10% of the AIT shares. This income<br />

has been determined after reclassification in income<br />

statement of fair value adjustments (EUR 1.136<br />

thousand) accounted for in reserves during the previous<br />

periods. The shares had been received by <strong>Hamon</strong> as a<br />

partial payment for the sale of Brown Fintube France<br />

(BFT) to this company in 2010.<br />

Other non-recurring items include the costs linked to<br />

the liquidation of Ohl.