Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Part 1 - General presentation of the Group<br />

35<br />

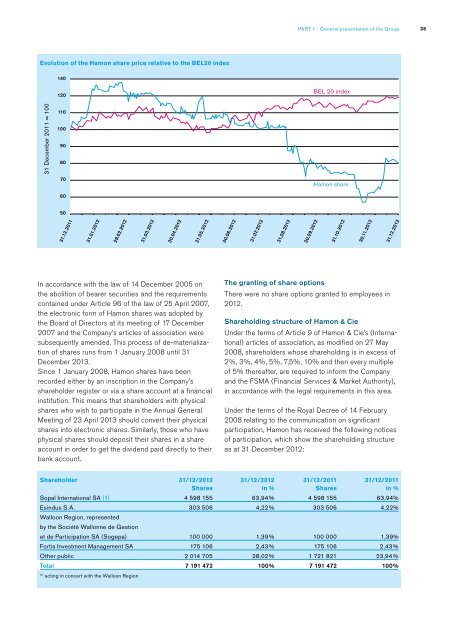

Evolution of the <strong>Hamon</strong> share price relative to the BEL20 index<br />

140<br />

120<br />

BEL 20 index<br />

31 December 2011 = 100<br />

110<br />

100<br />

90<br />

80<br />

70<br />

<strong>Hamon</strong> share<br />

60<br />

50<br />

31.12.2011<br />

31.01.2012<br />

29.02.2012<br />

31.03.2012<br />

30.04.2012<br />

31.05.2012<br />

30.06.2012<br />

31.07.2012<br />

31.08.2012<br />

30.09.2012<br />

31.10.2012<br />

30.11.2012<br />

31.12.2012<br />

In accordance with the law of 14 December 2005 on<br />

the abolition of bearer securities and the requirements<br />

contained under Article 96 of the law of 25 April 2007,<br />

the electronic form of <strong>Hamon</strong> shares was adopted by<br />

the Board of Directors at its meeting of 17 December<br />

2007 and the Company’s articles of association were<br />

subsequently amended. This process of de-materialization<br />

of shares runs from 1 January 2008 until 31<br />

December 2013.<br />

Since 1 January 2008, <strong>Hamon</strong> shares have been<br />

recorded either by an inscription in the Company’s<br />

shareholder register or via a share account at a financial<br />

institution. This means that shareholders with physical<br />

shares who wish to participate in the Annual General<br />

Meeting of 23 April 2013 should convert their physical<br />

shares into electronic shares. Similarly, those who have<br />

physical shares should deposit their shares in a share<br />

account in order to get the dividend paid directly to their<br />

bank account.<br />

The granting of share options<br />

There were no share options granted to employees in<br />

2012.<br />

Shareholding structure of <strong>Hamon</strong> & Cie<br />

Under the terms of Article 9 of <strong>Hamon</strong> & Cie’s (International)<br />

articles of association, as modified on 27 May<br />

2008, shareholders whose shareholding is in excess of<br />

2%, 3%, 4%, 5%, 7,5%, 10% and then every multiple<br />

of 5% thereafter, are required to inform the Company<br />

and the FSMA (Financial Services & Market Authority),<br />

in accordance with the legal requirements in this area.<br />

Under the terms of the Royal Decree of 14 February<br />

2008 relating to the communication on significant<br />

participation, <strong>Hamon</strong> has received the following notices<br />

of participation, which show the shareholding structure<br />

as at 31 December 2012:<br />

Shareholder<br />

Sopal International SA (1)<br />

Esindus S.A.<br />

Walloon Region, represented<br />

by the Société Wallonne de Gestion<br />

et de Participation SA (Sogepa)<br />

Fortis Investment Management SA<br />

Other public<br />

Total<br />

(1)<br />

acting in concert with the Walloon Region<br />

31/12/2012 31/12/2012 31/12/2011 31/12/2011<br />

shares in % shares in %<br />

4 598 155 63,94 % 4 598 155 63,94 %<br />

303 506 4,22 % 303 506 4,22 %<br />

100 000 1,39 % 100 000 1,39 %<br />

175 106 2,43 % 175 106 2,43 %<br />

2 014 705 28,02 % 1 721 821 23,94 %<br />

7 191 472 100% 7 191 472 100%