Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part 3 - Financial statements<br />

89<br />

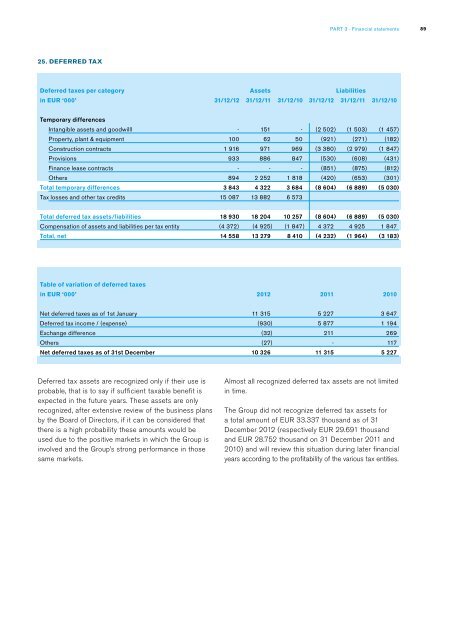

25. Deferred tax<br />

Deferred taxes per category<br />

in EUR ‘000’<br />

Assets<br />

liabilities<br />

31/12/12 31/12/11 31/12/10 31/12/12 31/12/11 31/12/10<br />

Temporary differences<br />

Intangible assets and goodwilll<br />

Property, plant & equipment<br />

Construction contracts<br />

Provisions<br />

Finance lease contracts<br />

Others<br />

Total temporary differences<br />

Tax losses and other tax credits<br />

- 151 - (2 502 ) (1 503 ) (1 457 )<br />

100 62 50 (921) (271) (182)<br />

1 916 971 969 (3 380 ) (2 979 ) (1 847 )<br />

933 886 847 (530) (608) (431)<br />

- - - (851) (875) (812)<br />

894 2 252 1 818 (420) (653) (301)<br />

3 843 4 322 3 684 (8 604 ) (6 889 ) (5 030 )<br />

15 087 13 882 6 573<br />

Total deferred tax assets/liabilities<br />

Compensation of assets and liabilities per tax entity<br />

Total, net<br />

18 930 18 204 10 257 (8 604 ) (6 889 ) (5 030 )<br />

(4 372) (4 925 ) (1 847 ) 4 372 4 925 1 847<br />

14 558 13 279 8 410 (4 232 ) (1 964 ) (3 183 )<br />

Table of variation of deferred taxes<br />

in EUR ‘000’<br />

2012 2011 2010<br />

Net deferred taxes as of 1st January<br />

Deferred tax income / (expense)<br />

Exchange difference<br />

Others<br />

Net deferred taxes as of 31st December<br />

11 315 5 227 3 647<br />

(930) 5 877 1 194<br />

(32) 211 269<br />

(27) - 117<br />

10 326 11 315 5 227<br />

Deferred tax assets are recognized only if their use is<br />

probable, that is to say if sufficient taxable benefit is<br />

expected in the future years. These assets are only<br />

recognized, after extensive review of the business plans<br />

by the Board of Directors, if it can be considered that<br />

there is a high probability these amounts would be<br />

used due to the positive markets in which the Group is<br />

involved and the Group’s strong performance in those<br />

same markets.<br />

Almost all recognized deferred tax assets are not limited<br />

in time.<br />

The Group did not recognize deferred tax assets for<br />

a total amount of EUR 33.337 thousand as of 31<br />

December 2012 (respectively EUR 29.691 thousand<br />

and EUR 28.752 thousand on 31 December 2011 and<br />

2010) and will review this situation during later financial<br />

years according to the profitability of the various tax entities.