Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

40<br />

<strong>Hamon</strong> Annual Report 2012<br />

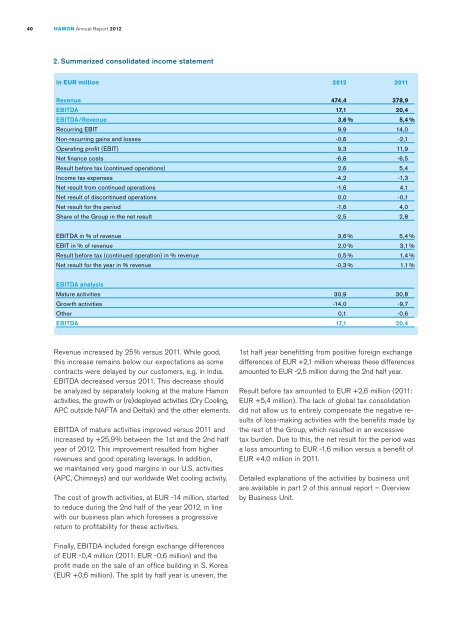

2. Summarized consolidated income statement<br />

in EUR million<br />

Revenue<br />

EBITDA<br />

EBITDA/Revenue<br />

Recurring EBIT<br />

Non-recurring gains and losses<br />

Operating profit (EBIT)<br />

Net finance costs<br />

Result before tax (continued operations)<br />

Income tax expenses<br />

Net result from continued operations<br />

Net result of discontinued operations<br />

Net result for the period<br />

Share of the Group in the net result<br />

2012 2011<br />

474,4 378,9<br />

17,1 20,4<br />

3,6 % 5,4 %<br />

9,9 14,0<br />

-0,6 -2,1<br />

9,3 11,9<br />

-6,8 -6,5<br />

2,6 5,4<br />

-4,2 -1,3<br />

-1,6 4,1<br />

0,0 -0,1<br />

-1,6 4,0<br />

-2,5 2,8<br />

EBITDA in % of revenue<br />

EBIT in % of revenue<br />

Result before tax (continued operation) in % revenue<br />

Net result for the year in % revenue<br />

3,6 % 5,4 %<br />

2,0 % 3,1 %<br />

0,5 % 1,4 %<br />

-0,3 % 1,1 %<br />

EBITDA analysis<br />

Mature activities<br />

Growth activities<br />

Other<br />

EBITDA<br />

30,9 30,8<br />

-14,0 -9,7<br />

0,1 -0,6<br />

17,1 20,4<br />

Revenue increased by 25% versus 2011. While good,<br />

this increase remains below our expectations as some<br />

contracts were delayed by our customers, e.g. in India.<br />

EBITDA decreased versus 2011. This decrease should<br />

be analyzed by separately looking at the mature <strong>Hamon</strong><br />

activities, the growth or (re)deployed activities (Dry Cooling,<br />

APC outside NAFTA and Deltak) and the other elements.<br />

EBITDA of mature activities improved versus 2011 and<br />

increased by +25,9% between the 1st and the 2nd half<br />

year of 2012. This improvement resulted from higher<br />

revenues and good operating leverage. In addition,<br />

we maintained very good margins in our U.S. activities<br />

(APC, Chimneys) and our worldwide Wet cooling activity.<br />

The cost of growth activities, at EUR -14 million, started<br />

to reduce during the 2nd half of the year 2012, in line<br />

with our business plan which foresees a progressive<br />

return to profitability for these activities.<br />

1st half year benefitting from positive foreign exchange<br />

differences of EUR +2,1 million whereas these differences<br />

amounted to EUR -2,5 million during the 2nd half year.<br />

Result before tax amounted to EUR +2,6 million (2011:<br />

EUR +5,4 million). The lack of global tax consolidation<br />

did not allow us to entirely compensate the negative results<br />

of loss-making activities with the benefits made by<br />

the rest of the Group, which resulted in an excessive<br />

tax burden. Due to this, the net result for the period was<br />

a loss amounting to EUR -1,6 million versus a benefit of<br />

EUR +4,0 million in 2011.<br />

Detailed explanations of the activities by business unit<br />

are available in part 2 of this annual report – Overview<br />

by Business Unit.<br />

Finally, EBITDA included foreign exchange differences<br />

of EUR -0,4 million (2011: EUR -0,6 million) and the<br />

profit made on the sale of an office building in S. Korea<br />

(EUR +0,6 million). The split by half year is uneven, the