Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part 3 - Financial statements<br />

85<br />

The development costs include on the one hand, use<br />

rights on the softwares obtained through the Deltak<br />

acquisition and, on the other hand, the capitalized<br />

internal development costs, mainly related to developments<br />

made in order to remain at the forefront of the<br />

technology in cooling systems.<br />

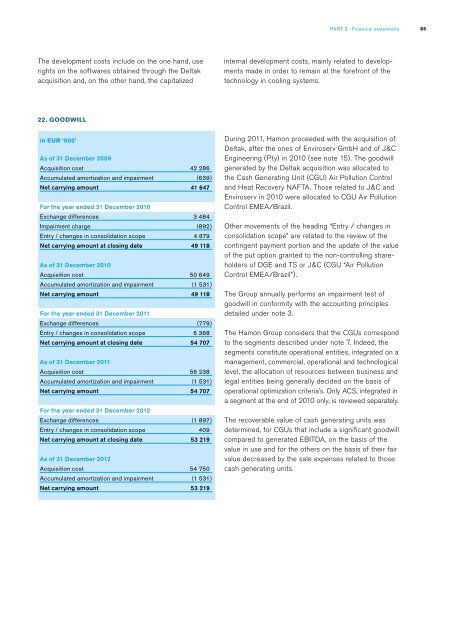

22. GOODWILL<br />

in EUR ‘000’<br />

As of 31 December 2009<br />

Acquisition cost<br />

Accumulated amortization and impairment<br />

Net carrying amount<br />

For the year ended 31 December 2010<br />

Exchange differences<br />

Impairment charge<br />

Entry / changes in consolidation scope<br />

Net carrying amount at closing date<br />

As of 31 December 2010<br />

Acquisition cost<br />

Accumulated amortization and impairment<br />

Net carrying amount<br />

For the year ended 31 December 2011<br />

Exchange differences<br />

Entry / changes in consolidation scope<br />

Net carrying amount at closing date<br />

As of 31 December 2011<br />

Acquisition cost<br />

Accumulated amortization and impairment<br />

Net carrying amount<br />

For the year ended 31 December 2012<br />

Exchange differences<br />

Entry / changes in consolidation scope<br />

Net carrying amount at closing date<br />

As of 31 December 2012<br />

Acquisition cost<br />

Accumulated amortization and impairment<br />

Net carrying amount<br />

42 286<br />

(639)<br />

41 647<br />

3 484<br />

(892)<br />

4 879<br />

49 118<br />

50 649<br />

(1 531 )<br />

49 118<br />

(779)<br />

6 368<br />

54 707<br />

56 238<br />

(1 531 )<br />

54 707<br />

(1 897 )<br />

409<br />

53 219<br />

54 750<br />

(1 531 )<br />

53 219<br />

During 2011, <strong>Hamon</strong> proceeded with the acquisition of<br />

Deltak, after the ones of Enviroserv GmbH and of J&C<br />

Engineering (Pty) in 2010 (see note 15). The goodwill<br />

generated by the Deltak acquisition was allocated to<br />

the Cash Generating Unit (CGU) Air Pollution Control<br />

and Heat Recovery NAFTA. Those related to J&C and<br />

Enviroserv in 2010 were allocated to CGU Air Pollution<br />

Control EMEA/Brazil.<br />

Other movements of the heading “Entry / changes in<br />

consolidation scope” are related to the review of the<br />

contingent payment portion and the update of the value<br />

of the put option granted to the non-controlling shareholders<br />

of DGE and TS or J&C (CGU “Air Pollution<br />

Control EMEA/Brazil”).<br />

The Group annually performs an impairment test of<br />

goodwill in conformity with the accounting principles<br />

detailed under note 3.<br />

The <strong>Hamon</strong> Group considers that the CGUs correspond<br />

to the segments described under note 7. Indeed, the<br />

segments constitute operational entities, integrated on a<br />

management, commercial, operational and technological<br />

level, the allocation of resources between business and<br />

legal entities being generally decided on the basis of<br />

operational optimization criteria’s. Only ACS, integrated in<br />

a segment at the end of 2010 only, is reviewed separately.<br />

The recoverable value of cash generating units was<br />

determined, for CGUs that include a significant goodwill<br />

compared to generated EBITDA, on the basis of the<br />

value in use and for the others on the basis of their fair<br />

value decreased by the sale expenses related to those<br />

cash generating units.