Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Part 1 - General presentation of the Group<br />

29<br />

January 2008), and to be divided up annually amongst<br />

its members by the Board of Directors.<br />

In 2012, the remuneration of these mandates came to<br />

EUR 182 200.<br />

The non-executive directors do not receive stock options<br />

or bonuses tied to the Company performances.<br />

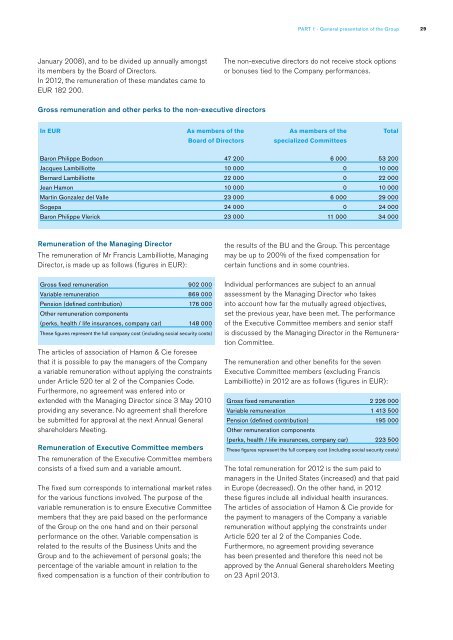

Gross remuneration and other perks to the non-executive directors<br />

In EUR As members of the As members of the Total<br />

Board of Directors specialized Committees<br />

Baron Philippe Bodson 47 200 6 000 53 200<br />

Jacques Lambilliotte 10 000 0 10 000<br />

Bernard Lambilliotte 22 000 0 22 000<br />

Jean <strong>Hamon</strong> 10 000 0 10 000<br />

Martin Gonzalez del Valle 23 000 6 000 29 000<br />

Sogepa 24 000 0 24 000<br />

Baron Philippe Vlerick 23 000 11 000 34 000<br />

Remuneration of the Managing Director<br />

The remuneration of Mr Francis Lambilliotte, Managing<br />

Director, is made up as follows (figures in EUR):<br />

Gross fixed remuneration 902 000<br />

Variable remuneration 869 000<br />

Pension (defined contribution) 176 000<br />

Other remuneration components<br />

(perks, health / life insurances, company car) 148 000<br />

These figures represent the full company cost (including social security costs)<br />

The articles of association of <strong>Hamon</strong> & Cie foresee<br />

that it is possible to pay the managers of the Company<br />

a variable remuneration without applying the constraints<br />

under Article 520 ter al 2 of the Companies Code.<br />

Furthermore, no agreement was entered into or<br />

extended with the Managing Director since 3 May 2010<br />

providing any severance. No agreement shall therefore<br />

be submitted for approval at the next Annual General<br />

shareholders Meeting.<br />

Remuneration of Executive Committee members<br />

The remuneration of the Executive Committee members<br />

consists of a fixed sum and a variable amount.<br />

The fixed sum corresponds to international market rates<br />

for the various functions involved. The purpose of the<br />

variable remuneration is to ensure Executive Committee<br />

members that they are paid based on the performance<br />

of the Group on the one hand and on their personal<br />

performance on the other. Variable compensation is<br />

related to the results of the Business Units and the<br />

Group and to the achievement of personal goals; the<br />

percentage of the variable amount in relation to the<br />

fixed compensation is a function of their contribution to<br />

the results of the BU and the Group. This percentage<br />

may be up to 200% of the fixed compensation for<br />

certain functions and in some countries.<br />

Individual performances are subject to an annual<br />

assessment by the Managing Director who takes<br />

into account how far the mutually agreed objectives,<br />

set the previous year, have been met. The performance<br />

of the Executive Committee members and senior staff<br />

is discussed by the Managing Director in the Remuneration<br />

Committee.<br />

The remuneration and other benefits for the seven<br />

Executive Committee members (excluding Francis<br />

Lambilliotte) in 2012 are as follows (figures in EUR):<br />

Gross fixed remuneration 2 226 000<br />

Variable remuneration 1 413 500<br />

Pension (defined contribution) 195 000<br />

Other remuneration components<br />

(perks, health / life insurances, company car) 223 500<br />

These figures represent the full company cost (including social security costs)<br />

The total remuneration for 2012 is the sum paid to<br />

managers in the United States (increased) and that paid<br />

in Europe (decreased). On the other hand, in 2012<br />

these figures include all individual health insurances.<br />

The articles of association of <strong>Hamon</strong> & Cie provide for<br />

the payment to managers of the Company a variable<br />

remuneration without applying the constraints under<br />

Article 520 ter al 2 of the Companies Code.<br />

Furthermore, no agreement providing severance<br />

has been presented and therefore this need not be<br />

approved by the Annual General shareholders Meeting<br />

on 23 April 2013.