Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

104<br />

<strong>Hamon</strong> Annual Report 2012<br />

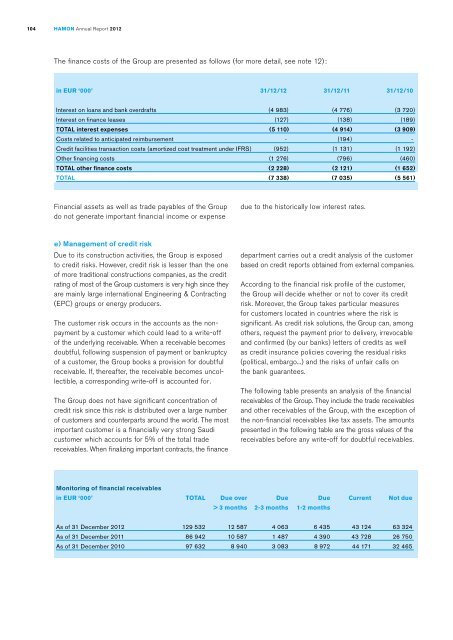

The finance costs of the Group are presented as follows (for more detail, see note 12) :<br />

in EUR ‘000’ 31/12/12 31/12/11 31/12/10<br />

Interest on loans and bank overdrafts (4 983 ) (4 776 ) (3 720 )<br />

Interest on finance leases (127) (138) (189)<br />

TOTAL interest expenses (5 110 ) (4 914 ) (3 909 )<br />

Costs related to anticipated reimbursement - (194) -<br />

Credit facilities transaction costs (amortized cost treatment under IFRS) (952) (1 131 ) (1 192 )<br />

Other financing costs (1 276 ) (796) (460)<br />

TOTAL other finance costs (2 228 ) (2 121 ) (1 652 )<br />

TOTAL (7 338 ) (7 035 ) (5 561 )<br />

Financial assets as well as trade payables of the Group<br />

do not generate important financial income or expense<br />

due to the historically low interest rates.<br />

e) Management of credit risk<br />

Due to its construction activities, the Group is exposed<br />

to credit risks. However, credit risk is lesser than the one<br />

of more traditional constructions companies, as the credit<br />

rating of most of the Group customers is very high since they<br />

are mainly large international Engineering & Contracting<br />

(EPC) groups or energy producers.<br />

The customer risk occurs in the accounts as the nonpayment<br />

by a customer which could lead to a write-off<br />

of the underlying receivable. When a receivable becomes<br />

doubtful, following suspension of payment or bankruptcy<br />

of a customer, the Group books a provision for doubtful<br />

receivable. If, thereafter, the receivable becomes uncollectible,<br />

a corresponding write-off is accounted for .<br />

The Group does not have significant concentration of<br />

credit risk since this risk is distributed over a large number<br />

of customers and counterparts around the world. The most<br />

important customer is a financially very strong Saudi<br />

customer which accounts for 5% of the total trade<br />

receivables. When finalizing important contracts, the finance<br />

department carries out a credit analysis of the customer<br />

based on credit reports obtained from external companies.<br />

According to the financial risk profile of the customer,<br />

the Group will decide whether or not to cover its credit<br />

risk. Moreover, the Group takes particular measures<br />

for customers located in countries where the risk is<br />

significant. As credit risk solutions, the Group can, among<br />

others, request the payment prior to delivery, irrevocable<br />

and confirmed (by our banks) letters of credits as well<br />

as credit insurance policies covering the residual risks<br />

(political, embargo...) and the risks of unfair calls on<br />

the bank guarantees.<br />

The following table presents an analysis of the financial<br />

receivables of the Group. They include the trade receivables<br />

and other receivables of the Group, with the exception of<br />

the non-financial receivables like tax assets. The amounts<br />

presented in the following table are the gross values of the<br />

receivables before any write-off for doubtful receivables.<br />

Monitoring of financial receivables<br />

in EUR ‘000’ TOTAL Due over Due Due Current Not due<br />

> 3 months 2-3 months 1-2 months<br />

As of 31 December 2012 129 532 12 587 4 063 6 435 43 124 63 324<br />

As of 31 December 2011 86 942 10 587 1 487 4 390 43 728 26 750<br />

As of 31 December 2010 97 632 8 940 3 083 8 972 44 171 32 465