Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

80<br />

<strong>Hamon</strong> Annual Report 2012<br />

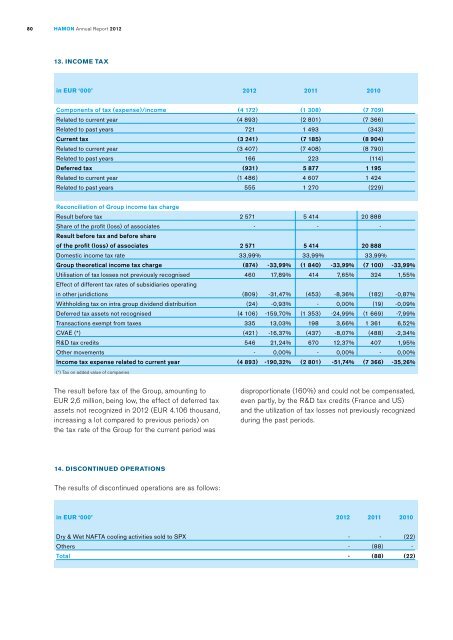

13. Income tax<br />

in EUR ‘000’<br />

2012 2011 2010<br />

Components of tax (expense)/income<br />

Related to current year<br />

Related to past years<br />

Current tax<br />

Related to current year<br />

Related to past years<br />

Deferred tax<br />

Related to current year<br />

Related to past years<br />

(4 172 ) (1 308 ) (7 709 )<br />

(4 893 ) (2 801 ) (7 366 )<br />

721 1 493 (343)<br />

(3 241 ) (7 185 ) (8 904 )<br />

(3 407 ) (7 408 ) (8 790 )<br />

166 223 (114 )<br />

(931) 5 877 1 195<br />

(1 486 ) 4 607 1 424<br />

555 1 270 (229)<br />

Reconciliation of Group income tax charge<br />

Result before tax<br />

Share of the profit (loss) of associates<br />

Result before tax and before share<br />

of the profit (loss) of associates<br />

Domestic income tax rate<br />

Group theoretical income tax charge<br />

Utilisation of tax losses not previously recognised<br />

Effect of different tax rates of subsidiaries operating<br />

in other juridictions<br />

Withholding tax on intra group dividend distribuition<br />

Deferred tax assets not recognised<br />

Transactions exempt from taxes<br />

CVAE (*)<br />

R&D tax credits<br />

Other movements<br />

Income tax expense related to current year<br />

(*) Tax on added value of companies<br />

2 571 5 414 20 888<br />

- - -<br />

2 571 5 414 20 888<br />

33,99 % 33,99 % 33,99 %<br />

(874) -33,99% (1 840 ) -33,99% (7 100 ) -33,99%<br />

460 17,89 % 414 7,65 % 324 1,55 %<br />

(809) -31,47% (453) -8,36% (182) -0,87%<br />

(24) -0,93% - 0,00 % (19) -0,09%<br />

(4 106 ) -159,70% (1 353 ) -24,99% (1 669 ) -7,99%<br />

335 13,03 % 198 3,66 % 1 361 6,52 %<br />

(421) -16,37% (437) -8,07% (488) -2,34%<br />

546 21,24 % 670 12,37 % 407 1,95 %<br />

- 0,00 % - 0,00 % - 0,00 %<br />

(4 893 ) -190,32% (2 801 ) -51,74% (7 366 ) -35,26%<br />

The result before tax of the Group, amounting to<br />

EUR 2,6 million, being low, the effect of deferred tax<br />

assets not recognized in 2012 (EUR 4.106 thousand,<br />

increasing a lot compared to previous periods) on<br />

the tax rate of the Group for the current period was<br />

disproportionate (160%) and could not be compensated,<br />

even partly, by the R&D tax credits (France and US)<br />

and the utilization of tax losses not previously recognized<br />

during the past periods.<br />

14. Discontinued operations<br />

The results of discontinued operations are as follows:<br />

in EUR ‘000’<br />

2012 2011 2010<br />

Dry & Wet NAFTA cooling activities sold to SPX<br />

Others<br />

Total<br />

- - (22)<br />

- (88) -<br />

- (88) (22)