Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

86<br />

<strong>Hamon</strong> Annual Report 2012<br />

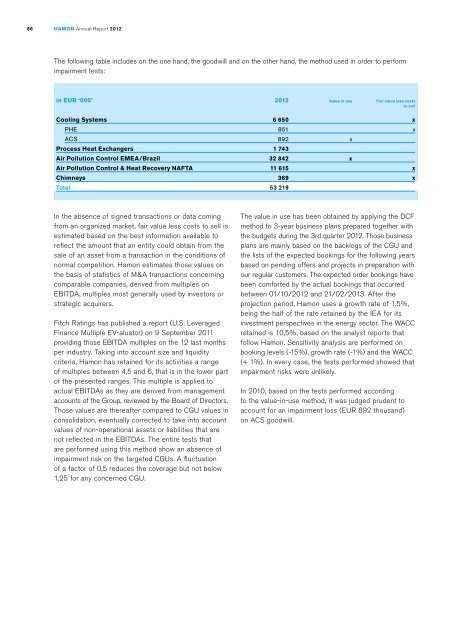

The following table includes on the one hand, the goodwill and on the other hand, the method used in order to perform<br />

impairment tests:<br />

in EUR ‘000’<br />

Cooling Systems<br />

PHE<br />

ACS<br />

Process Heat Exchangers<br />

Air Pollution Control EMEA/Brazil<br />

Air Pollution Control & Heat Recovery NAFTA<br />

Chimneys<br />

Total<br />

2012 Value in use Fair value less costs<br />

to sell<br />

6 650 x<br />

851 x<br />

892 x<br />

1 743<br />

32 842 x<br />

11 615 x<br />

369 x<br />

53 219<br />

In the absence of signed transactions or data coming<br />

from an organized market, fair value less costs to sell is<br />

estimated based on the best information available to<br />

reflect the amount that an entity could obtain from the<br />

sale of an asset from a transaction in the conditions of<br />

normal competition. <strong>Hamon</strong> estimates those values on<br />

the basis of statistics of M&A transactions concerning<br />

comparable companies, derived from multiples on<br />

EBITDA, multiples most generally used by investors or<br />

strategic acquirers.<br />

Fitch Ratings has published a report (U.S. Leveraged<br />

Finance Multiple EV-aluator) on 9 September 2011<br />

providing those EBITDA multiples on the 12 last months<br />

per industry. Taking into account size and liquidity<br />

criteria, <strong>Hamon</strong> has retained for its activities a range<br />

of multiples between 4,5 and 6, that is in the lower part<br />

of the presented ranges. This multiple is applied to<br />

actual EBITDAs as they are derived from management<br />

accounts of the Group, reviewed by the Board of Directors.<br />

Those values are thereafter compared to CGU values in<br />

consolidation, eventually corrected to take into account<br />

values of non-operational assets or liabilities that are<br />

not reflected in the EBITDAs. The entire tests that<br />

are performed using this method show an absence of<br />

impairment risk on the targeted CGUs. A fluctuation<br />

of a factor of 0,5 reduces the coverage but not below<br />

1,25 for any concerned CGU.<br />

The value in use has been obtained by applying the DCF<br />

method to 3-year business plans prepared together with<br />

the budgets during the 3rd quarter 2012. Those business<br />

plans are mainly based on the backlogs of the CGU and<br />

the lists of the expected bookings for the following years<br />

based on pending offers and projects in preparation with<br />

our regular customers. The expected order bookings have<br />

been comforted by the actual bookings that occurred<br />

between 01/10/2012 and 21/02/2013. After the<br />

projection period, <strong>Hamon</strong> uses a growth rate of 1,5%,<br />

being the half of the rate retained by the IEA for its<br />

investment perspectives in the energy sector. The WACC<br />

retained is 10,5%, based on the analyst reports that<br />

follow <strong>Hamon</strong>. Sensitivity analysis are performed on<br />

booking levels (-15%), growth rate (-1%) and the WACC<br />

(+ 1%). In every case, the tests performed showed that<br />

impairment risks were unlikely.<br />

In 2010, based on the tests performed according<br />

to the value-in-use method, it was judged prudent to<br />

account for an impairment loss (EUR 892 thousand)<br />

on ACS goodwill.