Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

110<br />

<strong>Hamon</strong> Annual Report 2012<br />

42. CONTINGENT LIABILITIES<br />

No new significant litigation occurred in 2011 and 2012. The only outstanding litigations are as follows:<br />

Bankruptcy of <strong>Hamon</strong> Research-Cottrell Italia (HRCI)<br />

The General Assembly of HRCI decided to put this<br />

company into voluntary liquidation in April 2005.<br />

<strong>Hamon</strong> had already accrued for a significant amount in<br />

its 2004 accounts for this bankruptcy. In June 2005,<br />

the liquidator filed the books at the commercial court of<br />

Milan. An agreement was signed between <strong>Hamon</strong> and<br />

the bankruptcy administrator of HRCI in July 2008.<br />

FBM Hudson Italiana<br />

The Italian company FBM Hudson Italiana Spa, sold by<br />

<strong>Hamon</strong> Group in December 2005 has initiated proceedings<br />

against its former directors. FBM was dismissed and<br />

sentenced to pay legal expenses by the Court of Genoa.<br />

FBM appealed on the part of the judgment ordering<br />

the payment of damages and interests for reckless and<br />

vexatious procedure (EUR 100 thousand).<br />

Asbestos<br />

The Group is involved in various proceedings for physical<br />

injuries related to asbestos. These relate to a period prior<br />

to the acquisition of the assets of Research Cottrell,<br />

Inc. by the Group in 1998. Asbestos is not used in the<br />

operations of <strong>Hamon</strong> in the USA. In the acquisition<br />

agreements of 1998, the seller committed itself to<br />

compensate the Group for all damage sustained because<br />

of such proceedings. The costs of these proceedings<br />

are, till now, exclusively handled by the seller. Insofar as<br />

these proceedings go back to a period prior to the<br />

acquisition of the US subsidiaries of the Group and<br />

taking into account the compensation clause, <strong>Hamon</strong>’s<br />

management thinks that these do not present risks of<br />

significant liability for the Group.<br />

Other litigations<br />

The nature of the Group’s activities leads us to file /<br />

receive complaints about / from our suppliers and our<br />

customers. The complaints are covered by specific<br />

provisions from the moment that payouts are probable<br />

and where their amount can be reliably estimated.<br />

The Group believes that these complaints will not have a<br />

globally significant impact on <strong>Hamon</strong>’s financial situation.<br />

43. RELATED PARTIES<br />

The ultimate mother company of the Group is Sopal<br />

International SA. See note 30 for detailed structure of<br />

the shareholders of the Group. The transactions between<br />

the Company and its subsidiaries, which are related<br />

parties of the Company, have been eliminated from the<br />

consolidated accounts and are not considered in this note.<br />

Details of the transactions between the Company and<br />

the other related parties are detailed below :<br />

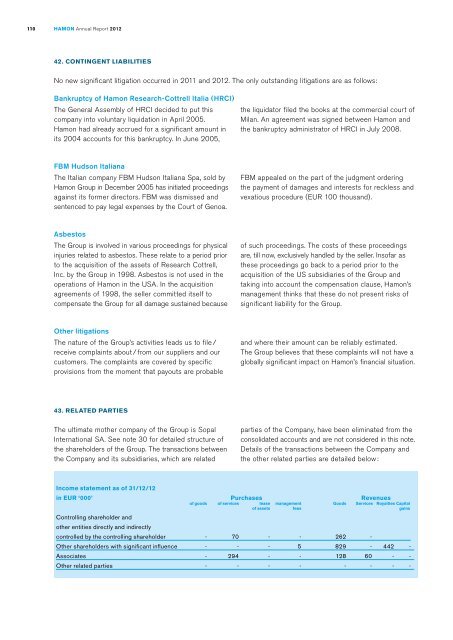

Income statement as of 31/12/12<br />

in EUR ‘000’ Purchases Revenues<br />

of goods of services lease management Goods Services Royalties Capital<br />

of assets fees gains<br />

Controlling shareholder and<br />

other entities directly and indirectly<br />

controlled by the controlling shareholder - 70 - - 262 -<br />

Other shareholders with significant influence - - - 5 829 - 442 -<br />

Associates - 294 - - 128 60 - -<br />

Other related parties - - - - - - - -