Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

Download PDF version English (3237KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Part 3 - Financial statements<br />

79<br />

Restructuring costs, amounting to EUR 1.123 thousand<br />

are mainly due to the ongoing plan to restore the<br />

profitability of BU APC EMEA/Brazil.<br />

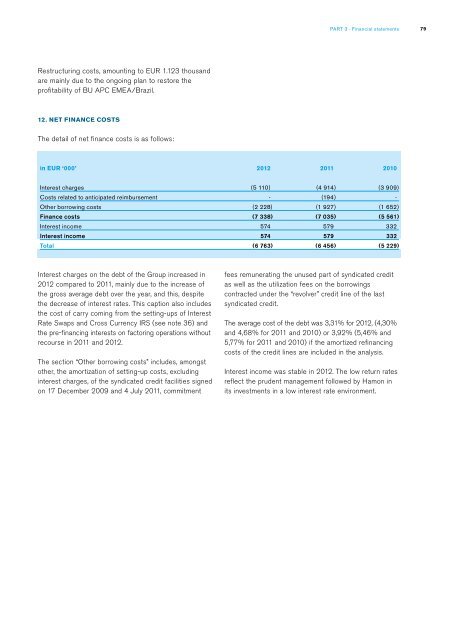

12. Net Finance costs<br />

The detail of net finance costs is as follows:<br />

in EUR ‘000’<br />

2012 2011 2010<br />

Interest charges<br />

Costs related to anticipated reimbursement<br />

Other borrowing costs<br />

Finance costs<br />

Interest income<br />

Interest income<br />

Total<br />

(5 110) (4 914 ) (3 909 )<br />

- (194) -<br />

(2 228 ) (1 927 ) (1 652 )<br />

(7 338 ) (7 035 ) (5 561 )<br />

574 579 332<br />

574 579 332<br />

(6 763 ) (6 456 ) (5 229 )<br />

Interest charges on the debt of the Group increased in<br />

2012 compared to 2011, mainly due to the increase of<br />

the gross average debt over the year, and this, despite<br />

the decrease of interest rates. This caption also includes<br />

the cost of carry coming from the setting-ups of Interest<br />

Rate Swaps and Cross Currency IRS (see note 36) and<br />

the pre-financing interests on factoring operations without<br />

recourse in 2011 and 2012.<br />

The section “Other borrowing costs” includes, amongst<br />

other, the amortization of setting-up costs, excluding<br />

interest charges, of the syndicated credit facilities signed<br />

on 17 December 2009 and 4 July 2011, commitment<br />

fees remunerating the unused part of syndicated credit<br />

as well as the utilization fees on the borrowings<br />

contracted under the “revolver” credit line of the last<br />

syndicated credit.<br />

The average cost of the debt was 3,31% for 2012, (4,30%<br />

and 4,68% for 2011 and 2010) or 3,92% (5,46% and<br />

5,77% for 2011 and 2010) if the amortized refinancing<br />

costs of the credit lines are included in the analysis.<br />

Interest income was stable in 2012. The low return rates<br />

reflect the prudent management followed by <strong>Hamon</strong> in<br />

its investments in a low interest rate environment.