Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

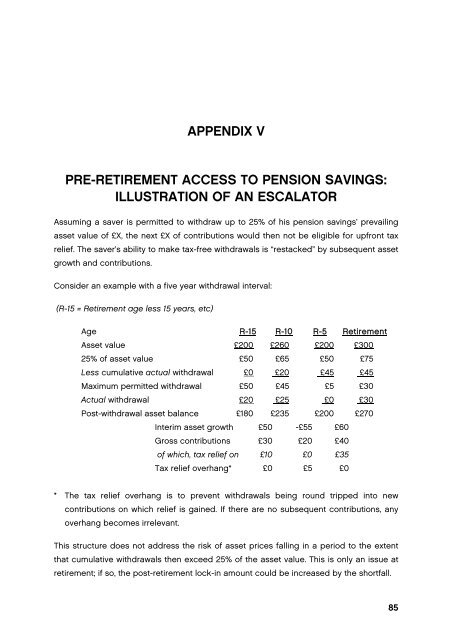

APPENDIX V<br />

PRE-RETIREMENT ACCESS TO PENSION SAVINGS:<br />

ILLUSTRATION OF AN ESCALATOR<br />

Assuming a saver <strong>is</strong> permitted to withdraw up to 25% of h<strong>is</strong> pension savings’ prevailing<br />

asset value of £X, <strong>the</strong> next £X of contributions would <strong>the</strong>n not be eligible <strong>for</strong> upfront tax<br />

relief. The saver’s ability to make tax-free withdrawals <strong>is</strong> “restacked” by subsequent asset<br />

growth and contributions.<br />

Consider an example with a five year withdrawal interval:<br />

(R-15 = Retirement age less 15 years, etc)<br />

Age R-15 R-10 R-5 Retirement<br />

Asset value £200 £260 £200 £300<br />

25% of asset value £50 £65 £50 £75<br />

Less cumulative actual withdrawal £0 £20 £45 £45<br />

Maximum permitted withdrawal £50 £45 £5 £30<br />

Actual withdrawal £20 £25 £0 £30<br />

Post-withdrawal asset balance £180 £235 £200 £270<br />

Interim asset growth £50 -£55 £60<br />

Gross contributions £30 £20 £40<br />

of which, tax relief on £10 £0 £35<br />

Tax relief overhang* £0 £5 £0<br />

* The tax relief overhang <strong>is</strong> to prevent withdrawals being round tripped into new<br />

contributions on which relief <strong>is</strong> gained. If <strong>the</strong>re are no subsequent contributions, any<br />

overhang becomes irrelevant.<br />

Th<strong>is</strong> structure does not address <strong>the</strong> r<strong>is</strong>k of asset prices falling in a period to <strong>the</strong> extent<br />

that cumulative withdrawals <strong>the</strong>n exceed 25% of <strong>the</strong> asset value. Th<strong>is</strong> <strong>is</strong> only an <strong>is</strong>sue at<br />

retirement; if so, <strong>the</strong> post-retirement lock-in amount could be increased by <strong>the</strong> shortfall.<br />

85