Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

annuity with <strong>the</strong>ir account proceeds, having assumed <strong>the</strong> investment r<strong>is</strong>k in <strong>the</strong><br />

interim, (akin to a defined contribution ("DC"), or money purchase, scheme). There <strong>is</strong> a<br />

general ban on transferring rights into and out of <strong>the</strong> scheme. NEST will be regulated<br />

in much <strong>the</strong> same way as ex<strong>is</strong>ting trust-based DC schemes.<br />

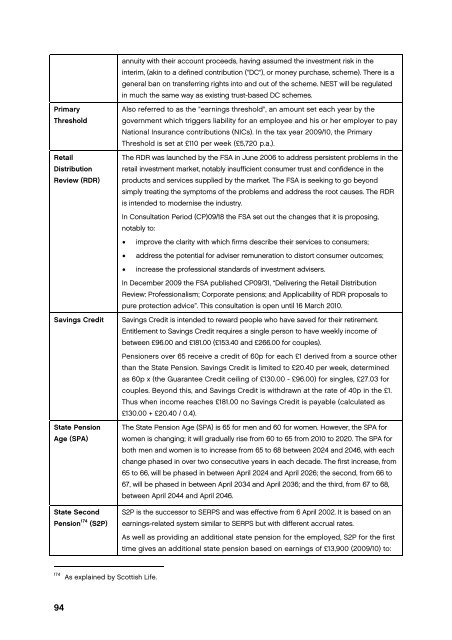

Primary<br />

Threshold<br />

Retail<br />

D<strong>is</strong>tribution<br />

Review (RDR)<br />

Savings Credit<br />

State Pension<br />

Age (SPA)<br />

State Second<br />

Pension 174 (S2P)<br />

Also referred to as <strong>the</strong> "earnings threshold", an amount set each year by <strong>the</strong><br />

government which triggers liability <strong>for</strong> an employee and h<strong>is</strong> or her employer to pay<br />

National Insurance contributions (NICs). In <strong>the</strong> tax year 2009/10, <strong>the</strong> Primary<br />

Threshold <strong>is</strong> set at £110 per week (£5,720 p.a.).<br />

The RDR was launched by <strong>the</strong> FSA in June 2006 to address pers<strong>is</strong>tent problems in <strong>the</strong><br />

retail investment market, notably insufficient consumer trust and confidence in <strong>the</strong><br />

products and services supplied by <strong>the</strong> market. The FSA <strong>is</strong> seeking to go beyond<br />

simply treating <strong>the</strong> symptoms of <strong>the</strong> problems and address <strong>the</strong> root causes. The RDR<br />

<strong>is</strong> intended to modern<strong>is</strong>e <strong>the</strong> industry.<br />

In Consultation Period (CP)09/18 <strong>the</strong> FSA set out <strong>the</strong> changes that it <strong>is</strong> proposing,<br />

notably to:<br />

improve <strong>the</strong> clarity with which firms describe <strong>the</strong>ir services to consumers;<br />

address <strong>the</strong> potential <strong>for</strong> adv<strong>is</strong>er remuneration to d<strong>is</strong>tort consumer outcomes;<br />

increase <strong>the</strong> professional standards of investment adv<strong>is</strong>ers.<br />

In December 2009 <strong>the</strong> FSA publ<strong>is</strong>hed CP09/31, “Delivering <strong>the</strong> Retail D<strong>is</strong>tribution<br />

Review: Professional<strong>is</strong>m; Corporate pensions; and Applicability of RDR proposals to<br />

pure protection advice”. Th<strong>is</strong> consultation <strong>is</strong> open until 16 March 2010.<br />

Savings Credit <strong>is</strong> intended to reward people who have saved <strong>for</strong> <strong>the</strong>ir retirement.<br />

Entitlement to Savings Credit requires a single person to have weekly income of<br />

between £96.00 and £181.00 (£153.40 and £266.00 <strong>for</strong> couples).<br />

Pensioners over 65 receive a credit of 60p <strong>for</strong> each £1 derived from a source o<strong>the</strong>r<br />

than <strong>the</strong> State Pension. Savings Credit <strong>is</strong> limited to £20.40 per week, determined<br />

as 60p x (<strong>the</strong> Guarantee Credit ceiling of £130.00 - £96.00) <strong>for</strong> singles, £27.03 <strong>for</strong><br />

couples. Beyond th<strong>is</strong>, and Savings Credit <strong>is</strong> withdrawn at <strong>the</strong> rate of 40p in <strong>the</strong> £1.<br />

Thus when income reaches £181.00 no Savings Credit <strong>is</strong> payable (calculated as<br />

£130.00 + £20.40 / 0.4).<br />

The State Pension Age (SPA) <strong>is</strong> 65 <strong>for</strong> men and 60 <strong>for</strong> women. However, <strong>the</strong> SPA <strong>for</strong><br />

women <strong>is</strong> changing; it will gradually r<strong>is</strong>e from 60 to 65 from 2010 to 2020. The SPA <strong>for</strong><br />

both men and women <strong>is</strong> to increase from 65 to 68 between 2024 and 2046, with each<br />

change phased in over two consecutive years in each decade. The first increase, from<br />

65 to 66, will be phased in between April 2024 and April 2026; <strong>the</strong> second, from 66 to<br />

67, will be phased in between April 2034 and April 2036; and <strong>the</strong> third, from 67 to 68,<br />

between April 2044 and April 2046.<br />

S2P <strong>is</strong> <strong>the</strong> successor to SERPS and was effective from 6 April 2002. It <strong>is</strong> based on an<br />

earnings-related system similar to SERPS but with different accrual rates.<br />

As well as providing an additional state pension <strong>for</strong> <strong>the</strong> employed, S2P <strong>for</strong> <strong>the</strong> first<br />

time gives an additional state pension based on earnings of £13,900 (2009/10) to:<br />

174 As explained by Scott<strong>is</strong>h Life.<br />

94