Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

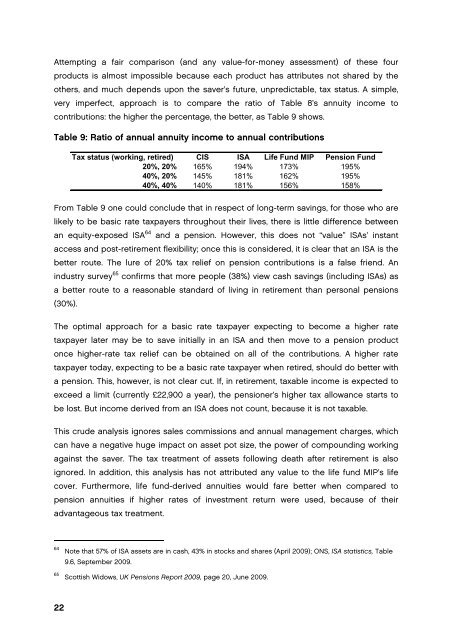

Attempting a fair compar<strong>is</strong>on (and any value-<strong>for</strong>-money assessment) of <strong>the</strong>se four<br />

products <strong>is</strong> almost impossible because each product has attributes not shared by <strong>the</strong><br />

o<strong>the</strong>rs, and much depends upon <strong>the</strong> saver’s future, unpredictable, tax status. A simple,<br />

very imperfect, approach <strong>is</strong> to compare <strong>the</strong> ratio of Table 8’s annuity income to<br />

contributions: <strong>the</strong> higher <strong>the</strong> percentage, <strong>the</strong> better, as Table 9 shows.<br />

Table 9: Ratio of annual annuity income to annual contributions<br />

Tax status (working, retired) CIS ISA Life Fund MIP Pension Fund<br />

20%, 20% 165% 194% 173% 195%<br />

40%, 20% 145% 181% 162% 195%<br />

40%, 40% 140% 181% 156% 158%<br />

From Table 9 one could conclude that in respect of long-term savings, <strong>for</strong> those who are<br />

likely to be basic rate taxpayers throughout <strong>the</strong>ir lives, <strong>the</strong>re <strong>is</strong> little difference between<br />

an equity-exposed ISA 64 and a pension. However, th<strong>is</strong> does not “value” ISAs’ instant<br />

access and post-retirement flexibility; once th<strong>is</strong> <strong>is</strong> considered, it <strong>is</strong> clear that an ISA <strong>is</strong> <strong>the</strong><br />

better route. The lure of 20% tax relief on pension contributions <strong>is</strong> a false friend. An<br />

industry survey 65 confirms that more people (38%) view cash savings (including ISAs) as<br />

a better route to a reasonable standard of living in retirement than personal pensions<br />

(30%).<br />

The optimal approach <strong>for</strong> a basic rate taxpayer expecting to become a higher rate<br />

taxpayer later may be to save initially in an ISA and <strong>the</strong>n move to a pension product<br />

once higher-rate tax relief can be obtained on all of <strong>the</strong> contributions. A higher rate<br />

taxpayer today, expecting to be a basic rate taxpayer when retired, should do better with<br />

a pension. Th<strong>is</strong>, however, <strong>is</strong> not clear cut. If, in retirement, taxable income <strong>is</strong> expected to<br />

exceed a limit (currently £22,900 a year), <strong>the</strong> pensioner’s higher tax allowance starts to<br />

be lost. But income derived from an ISA does not count, because it <strong>is</strong> not taxable.<br />

Th<strong>is</strong> crude analys<strong>is</strong> ignores sales comm<strong>is</strong>sions and annual management charges, which<br />

can have a negative huge impact on asset pot size, <strong>the</strong> power of compounding working<br />

against <strong>the</strong> saver. The tax treatment of assets following death after retirement <strong>is</strong> also<br />

ignored. In addition, th<strong>is</strong> analys<strong>is</strong> has not attributed any value to <strong>the</strong> life fund MIP’s life<br />

cover. Fur<strong>the</strong>rmore, life fund-derived annuities would fare better when compared to<br />

pension annuities if higher rates of investment return were used, because of <strong>the</strong>ir<br />

advantageous tax treatment.<br />

64<br />

65<br />

Note that 57% of ISA assets are in cash, 43% in stocks and shares (April 2009); ONS, ISA stat<strong>is</strong>tics, Table<br />

9.6, September 2009.<br />

Scott<strong>is</strong>h Widows, UK Pensions Report 2009, page 20, June 2009.<br />

22