Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Whilst <strong>the</strong> UK’s NRR <strong>for</strong> <strong>the</strong> mean earner <strong>is</strong> one of <strong>the</strong> lowest (41%), it <strong>is</strong> also has one of<br />

<strong>the</strong> most red<strong>is</strong>tributive: <strong>the</strong> NRR of low earners (64%) <strong>is</strong> more than double that of high<br />

earners (29%). The three lowest NRRs <strong>for</strong> high earners are in <strong>the</strong> UK, Ireland and New<br />

Zealand but <strong>the</strong> latter two have flat-rate pensions systems.<br />

UK pensioners make up <strong>the</strong>ir income by relying on private pension prov<strong>is</strong>ion to a greater<br />

extent than every o<strong>the</strong>r country in <strong>the</strong> OECD (excluding those with mandatory private or<br />

occupational schemes). The state clearly has a strong vested interest in encouraging<br />

people to save. Th<strong>is</strong> <strong>is</strong> not least because those who lack income in retirement o<strong>the</strong>rw<strong>is</strong>e<br />

fall back onto <strong>the</strong> state, mostly through <strong>the</strong> (means-tested) benefits system.<br />

5.2 Tax relief<br />

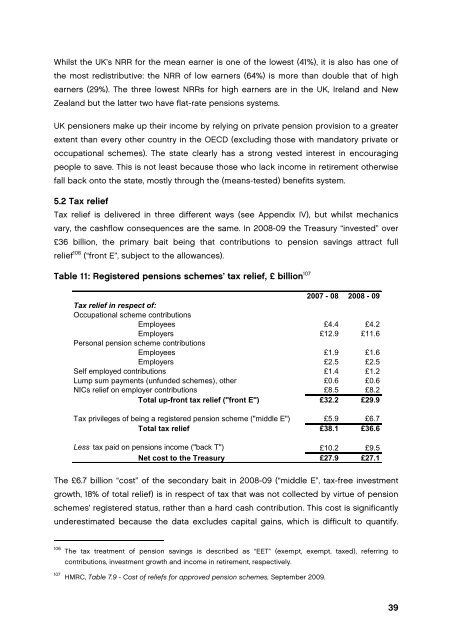

Tax relief <strong>is</strong> delivered in three different ways (see Appendix IV), but whilst mechanics<br />

vary, <strong>the</strong> cashflow consequences are <strong>the</strong> same. In 2008-09 <strong>the</strong> Treasury “invested” over<br />

£36 billion, <strong>the</strong> primary bait being that contributions to pension savings attract full<br />

relief 106 (“front E”, subject to <strong>the</strong> allowances).<br />

Table 11: Reg<strong>is</strong>tered pensions schemes’ tax relief, £ billion 107<br />

2007 - 08 2008 - 09<br />

Tax relief in respect of:<br />

Occupational scheme contributions<br />

Employees £4.4 £4.2<br />

Employers £12.9 £11.6<br />

Personal pension scheme contributions<br />

Employees £1.9 £1.6<br />

Employers £2.5 £2.5<br />

Self employed contributions £1.4 £1.2<br />

Lump sum payments (unfunded schemes), o<strong>the</strong>r £0.6 £0.6<br />

NICs relief on employer contributions £8.5 £8.2<br />

Total up-front tax relief ("front E") £32.2 £29.9<br />

Tax privileges of being a reg<strong>is</strong>tered pension scheme ("middle E") £5.9 £6.7<br />

Total tax relief £38.1 £36.6<br />

Less tax paid on pensions income ("back T") £10.2 £9.5<br />

Net cost to <strong>the</strong> Treasury £27.9 £27.1<br />

The £6.7 billion “cost” of <strong>the</strong> secondary bait in 2008-09 (“middle E”, tax-free investment<br />

growth, 18% of total relief) <strong>is</strong> in respect of tax that was not collected by virtue of pension<br />

schemes’ reg<strong>is</strong>tered status, ra<strong>the</strong>r than a hard cash contribution. Th<strong>is</strong> cost <strong>is</strong> significantly<br />

underestimated because <strong>the</strong> data excludes capital gains, which <strong>is</strong> difficult to quantify.<br />

106 The tax treatment of pension savings <strong>is</strong> described as “EET” (exempt, exempt, taxed), referring to<br />

contributions, investment growth and income in retirement, respectively.<br />

107 HMRC, Table 7.9 - Cost of reliefs <strong>for</strong> approved pension schemes, September 2009.<br />

39