Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

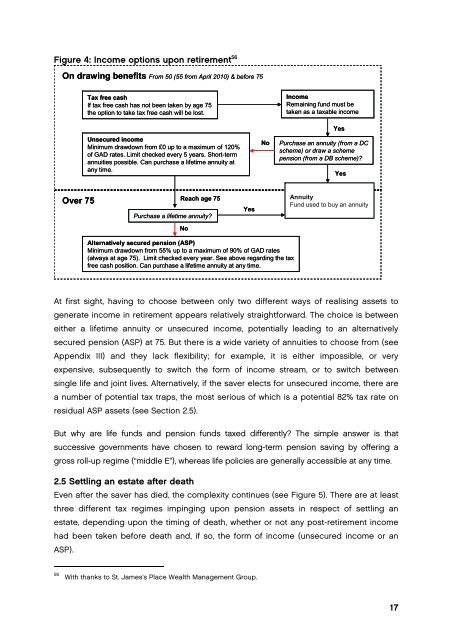

Figure 4: Income options upon retirement 56<br />

On drawing benefits From 50 (55 from April 2010) & be<strong>for</strong>e 75<br />

Tax free cash<br />

If tax free cash has not been taken by age 75<br />

<strong>the</strong> option to take tax free cash will be lost.<br />

Unsecured income<br />

Minimum drawdown from £0 up to a maximum of 120%<br />

of GAD rates. Limit checked every 5 years. Short-term<br />

annuities possible. Can purchase a lifetime annuity at<br />

any time.<br />

No<br />

Income<br />

Remaining fund must be<br />

taken as a taxable income<br />

Yes<br />

Purchase an annuity (from a DC<br />

scheme) or draw a scheme<br />

pension (from a DB scheme)?<br />

Yes<br />

Over 75<br />

Reach age 75<br />

Purchase a lifetime annuity?<br />

Yes<br />

Annuity<br />

Fund used to buy an annuity<br />

No<br />

Alternatively secured pension (ASP)<br />

Minimum drawdown from 55% up to a maximum of 90% of GAD rates<br />

(always at age 75). Limit checked every year. See above regarding <strong>the</strong> tax<br />

free cash position. Can purchase a lifetime annuity at any time.<br />

At first sight, having to choose between only two different ways of real<strong>is</strong>ing assets to<br />

generate income in retirement appears relatively straight<strong>for</strong>ward. The choice <strong>is</strong> between<br />

ei<strong>the</strong>r a lifetime annuity or unsecured income, potentially leading to an alternatively<br />

secured pension (ASP) at 75. But <strong>the</strong>re <strong>is</strong> a wide variety of annuities to choose from (see<br />

Appendix III) and <strong>the</strong>y lack flexibility; <strong>for</strong> example, it <strong>is</strong> ei<strong>the</strong>r impossible, or very<br />

expensive, subsequently to switch <strong>the</strong> <strong>for</strong>m of income stream, or to switch between<br />

single life and joint lives. Alternatively, if <strong>the</strong> saver elects <strong>for</strong> unsecured income, <strong>the</strong>re are<br />

a number of potential tax traps, <strong>the</strong> most serious of which <strong>is</strong> a potential 82% tax rate on<br />

residual ASP assets (see Section 2.5).<br />

But why are life funds and pension funds taxed differently? The simple answer <strong>is</strong> that<br />

successive governments have chosen to reward long-term pension saving by offering a<br />

gross roll-up regime (“middle E”), whereas life policies are generally accessible at any time.<br />

2.5 Settling an estate after death<br />

Even after <strong>the</strong> saver has died, <strong>the</strong> complexity continues (see Figure 5). There are at least<br />

three different tax regimes impinging upon pension assets in respect of settling an<br />

estate, depending upon <strong>the</strong> timing of death, whe<strong>the</strong>r or not any post-retirement income<br />

had been taken be<strong>for</strong>e death and, if so, <strong>the</strong> <strong>for</strong>m of income (unsecured income or an<br />

ASP).<br />

56<br />

With thanks to St. James’s Place Wealth Management Group.<br />

17