Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

There are o<strong>the</strong>r aspects to consider in <strong>the</strong> ISA versus pension debate. If <strong>the</strong> saver were<br />

to die be<strong>for</strong>e retirement, <strong>the</strong> value of <strong>the</strong>ir pension fund, if it has been written in trust, will<br />

fall outside <strong>the</strong>ir estate <strong>for</strong> inheritance tax (IHT) purposes, whereas an ISA might face IHT.<br />

Much depends upon <strong>the</strong> saver’s tax status both pre- and post-SPA retirement.<br />

Finally, potential annuitants have to consider <strong>the</strong> nuances of annuity pricing, which <strong>the</strong><br />

above analys<strong>is</strong> has ignored. Life funds, <strong>for</strong> example, price higher (i.e. lower annuity rates)<br />

than pension funds because of self-selection r<strong>is</strong>k; people voluntarily buying annuities<br />

with life fund proceeds expect to live longer than those compelled to buy <strong>the</strong>m with<br />

pension fund assets. In addition, <strong>the</strong>re are pricing implications <strong>for</strong> pension funds<br />

because <strong>the</strong>y include wider socio-economic groups.<br />

2.10 The gender gap<br />

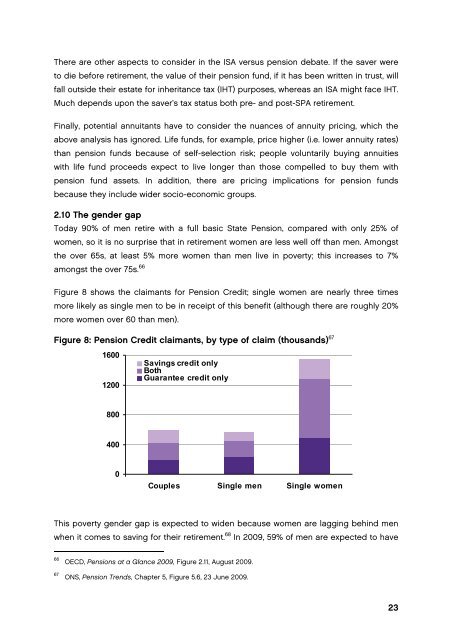

Today 90% of men retire with a full basic State Pension, compared with only 25% of<br />

women, so it <strong>is</strong> no surpr<strong>is</strong>e that in retirement women are less well off than men. Amongst<br />

<strong>the</strong> over 65s, at least 5% more women than men live in poverty; th<strong>is</strong> increases to 7%<br />

amongst <strong>the</strong> over 75s. 66<br />

Figure 8 shows <strong>the</strong> claimants <strong>for</strong> Pension Credit; single women are nearly three times<br />

more likely as single men to be in receipt of th<strong>is</strong> benefit (although <strong>the</strong>re are roughly 20%<br />

more women over 60 than men).<br />

Figure 8: Pension Credit claimants, by type of claim (thousands) 67<br />

1600<br />

1200<br />

Savings credit only<br />

Both<br />

Guarantee credit only<br />

800<br />

400<br />

0<br />

Couples Single men Single women<br />

Th<strong>is</strong> poverty gender gap <strong>is</strong> expected to widen because women are lagging behind men<br />

when it comes to saving <strong>for</strong> <strong>the</strong>ir retirement. 68 In 2009, 59% of men are expected to have<br />

66<br />

67<br />

OECD, Pensions at a Glance 2009, Figure 2.11, August 2009.<br />

ONS, Pension Trends, Chapter 5, Figure 5.6, 23 June 2009.<br />

23