Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Introduce a Junior ISA<br />

The ISA should be extended to <strong>the</strong> under-16s, perhaps branded as a “Junior ISA”, with<br />

an annual savings allowance of £1,200 (equivalent to £100 per month). Introduction of<br />

<strong>the</strong> Junior ISA would complete <strong>the</strong> association of <strong>the</strong> ISA brand with lifetime saving. 7<br />

Opportunities to reduce <strong>the</strong> deficit<br />

<strong>Simplification</strong> could be accompanied by an opportunity to save <strong>the</strong> Treasury<br />

considerable amounts of money without r<strong>is</strong>king a sharp reduction in long-term<br />

saving; a rare example of a policy “win-win”. In 2008-09 nearly £30 billion was spent<br />

in upfront tax relief, but <strong>the</strong> effectiveness of at least some of th<strong>is</strong> spend <strong>is</strong><br />

questionable, pension saving having become so unattractive, particularly <strong>for</strong> standard<br />

rate taxpayers. Indeed, upfront f<strong>is</strong>cal incentives have little impact on many people’s<br />

propensity to save; flexibility, including immediate access to savings, <strong>is</strong> <strong>the</strong>ir <strong>key</strong><br />

influencer (after <strong>the</strong> availability of cash).<br />

<br />

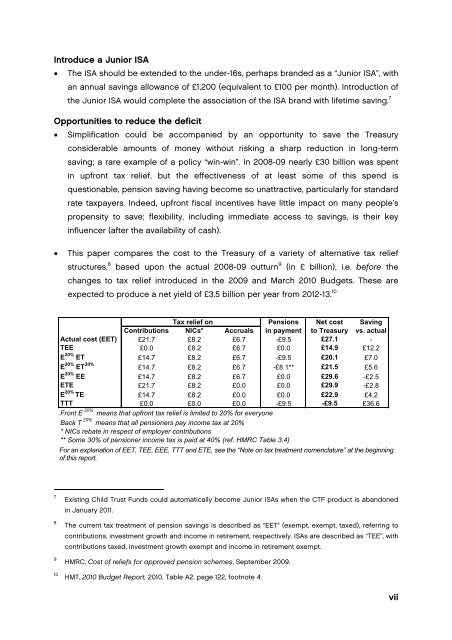

Th<strong>is</strong> paper compares <strong>the</strong> cost to <strong>the</strong> Treasury of a variety of alternative tax relief<br />

structures, 8 based upon <strong>the</strong> actual 2008-09 outturn 9 (in £ billion), i.e. be<strong>for</strong>e <strong>the</strong><br />

changes to tax relief introduced in <strong>the</strong> 2009 and March 2010 Budgets. These are<br />

expected to produce a net yield of £3.5 billion per year from 2012-13. 10<br />

Tax relief on Pensions Net cost Saving<br />

Contributions NICs* Accruals in payment to Treasury vs. actual<br />

Actual cost (EET) £21.7 £8.2 £6.7 -£9.5 £27.1 -<br />

TEE £0.0 £8.2 £6.7 £0.0 £14.9 £12.2<br />

E 20% ET £14.7 £8.2 £6.7 -£9.5 £20.1 £7.0<br />

E 20% ET 20% £14.7 £8.2 £6.7 -£8.1** £21.5 £5.6<br />

E 20% EE £14.7 £8.2 £6.7 £0.0 £29.6 -£2.5<br />

ETE £21.7 £8.2 £0.0 £0.0 £29.9 -£2.8<br />

E 20% TE £14.7 £8.2 £0.0 £0.0 £22.9 £4.2<br />

TTT £0.0 £0.0 £0.0 -£9.5 -£9.5 £36.6<br />

Front E 20% means that upfront tax relief <strong>is</strong> limited to 20% <strong>for</strong> everyone<br />

Back T 20% means that all pensioners pay income tax at 20%<br />

* NICs rebate in respect of employer contributions<br />

** Some 30% of pensioner income tax <strong>is</strong> paid at 40% (ref. HMRC Table 3.4)<br />

For an explanation of EET, TEE, EEE, TTT and ETE, see <strong>the</strong> “Note on tax treatment nomenclature” at <strong>the</strong> beginning<br />

of th<strong>is</strong> report.<br />

7<br />

8<br />

9<br />

10<br />

Ex<strong>is</strong>ting Child Trust Funds could automatically become Junior ISAs when <strong>the</strong> CTF product <strong>is</strong> abandoned<br />

in January 2011.<br />

The current tax treatment of pension savings <strong>is</strong> described as "EET" (exempt, exempt, taxed), referring to<br />

contributions, investment growth and income in retirement, respectively. ISAs are described as “TEE”, with<br />

contributions taxed, investment growth exempt and income in retirement exempt.<br />

HMRC, Cost of reliefs <strong>for</strong> approved pension schemes, September 2009.<br />

HMT, 2010 Budget Report, 2010, Table A2, page 122, footnote 4.<br />

vii