Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

a 10% rate of real investment return <strong>for</strong> basic rate taxpayers (and well beyond 10% <strong>for</strong><br />

higher tax rate payers).<br />

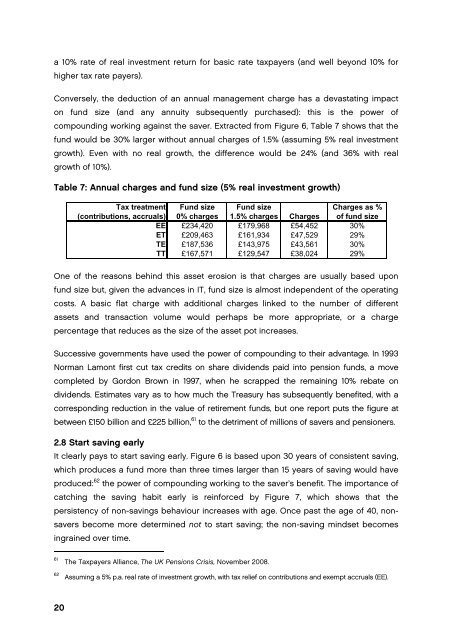

Conversely, <strong>the</strong> deduction of an annual management charge has a devastating impact<br />

on fund size (and any annuity subsequently purchased): th<strong>is</strong> <strong>is</strong> <strong>the</strong> power of<br />

compounding working against <strong>the</strong> saver. Extracted from Figure 6, Table 7 shows that <strong>the</strong><br />

fund would be 30% larger without annual charges of 1.5% (assuming 5% real investment<br />

growth). Even with no real growth, <strong>the</strong> difference would be 24% (and 36% with real<br />

growth of 10%).<br />

Table 7: Annual charges and fund size (5% real investment growth)<br />

Tax treatment Fund size Fund size Charges as %<br />

(contributions, accruals) 0% charges 1.5% charges Charges of fund size<br />

EE £234,420 £179,968 £54,452 30%<br />

ET £209,463 £161,934 £47,529 29%<br />

TE £187,536 £143,975 £43,561 30%<br />

TT £167,571 £129,547 £38,024 29%<br />

One of <strong>the</strong> reasons behind th<strong>is</strong> asset erosion <strong>is</strong> that charges are usually based upon<br />

fund size but, given <strong>the</strong> advances in IT, fund size <strong>is</strong> almost independent of <strong>the</strong> operating<br />

costs. A basic flat charge with additional charges linked to <strong>the</strong> number of different<br />

assets and transaction volume would perhaps be more appropriate, or a charge<br />

percentage that reduces as <strong>the</strong> size of <strong>the</strong> asset pot increases.<br />

Successive governments have used <strong>the</strong> power of compounding to <strong>the</strong>ir advantage. In 1993<br />

Norman Lamont first cut tax credits on share dividends paid into pension funds, a move<br />

completed by Gordon Brown in 1997, when he scrapped <strong>the</strong> remaining 10% rebate on<br />

dividends. Estimates vary as to how much <strong>the</strong> Treasury has subsequently benefited, with a<br />

corresponding reduction in <strong>the</strong> value of retirement funds, but one report puts <strong>the</strong> figure at<br />

between £150 billion and £225 billion, 61 to <strong>the</strong> detriment of millions of savers and pensioners.<br />

2.8 Start saving early<br />

It clearly pays to start saving early. Figure 6 <strong>is</strong> based upon 30 years of cons<strong>is</strong>tent saving,<br />

which produces a fund more than three times larger than 15 years of saving would have<br />

produced: 62 <strong>the</strong> power of compounding working to <strong>the</strong> saver’s benefit. The importance of<br />

catching <strong>the</strong> saving habit early <strong>is</strong> rein<strong>for</strong>ced by Figure 7, which shows that <strong>the</strong><br />

pers<strong>is</strong>tency of non-savings behaviour increases with age. Once past <strong>the</strong> age of 40, nonsavers<br />

become more determined not to start saving; <strong>the</strong> non-saving mindset becomes<br />

ingrained over time.<br />

61<br />

62<br />

The Taxpayers Alliance, The UK Pensions Cr<strong>is</strong><strong>is</strong>, November 2008.<br />

Assuming a 5% p.a. real rate of investment growth, with tax relief on contributions and exempt accruals (EE).<br />

20