Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

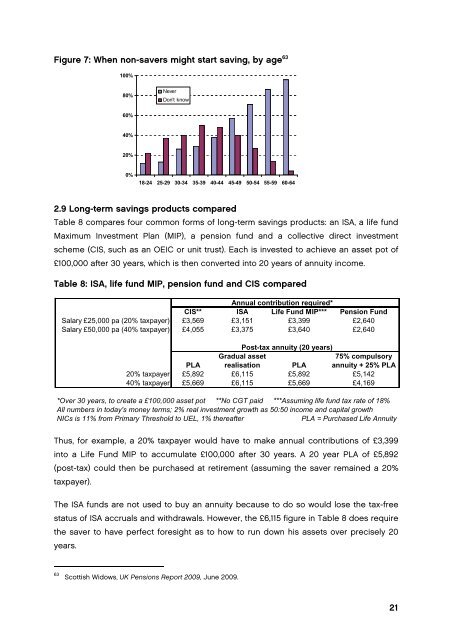

Figure 7: When non-savers might start saving, by age 63<br />

100%<br />

80%<br />

Never<br />

Don't know<br />

60%<br />

40%<br />

20%<br />

0%<br />

18-24 25-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64<br />

2.9 Long-term savings products compared<br />

Table 8 compares four common <strong>for</strong>ms of long-term savings products: an ISA, a life fund<br />

Maximum Investment Plan (MIP), a pension fund and a collective direct investment<br />

scheme (CIS, such as an OEIC or unit trust). Each <strong>is</strong> invested to achieve an asset pot of<br />

£100,000 after 30 years, which <strong>is</strong> <strong>the</strong>n converted into 20 years of annuity income.<br />

Table 8: ISA, life fund MIP, pension fund and CIS compared<br />

Annual contribution required*<br />

CIS** ISA Life Fund MIP*** Pension Fund<br />

Salary £25,000 pa (20% taxpayer) £3,569 £3,151 £3,399 £2,640<br />

Salary £50,000 pa (40% taxpayer) £4,055 £3,375 £3,640 £2,640<br />

Post-tax annuity (20 years)<br />

Gradual asset<br />

75% compulsory<br />

PLA real<strong>is</strong>ation PLA annuity + 25% PLA<br />

20% taxpayer £5,892 £6,115 £5,892 £5,142<br />

40% taxpayer £5,669 £6,115 £5,669 £4,169<br />

*Over 30 years, to create a £100,000 asset pot **No CGT paid ***Assuming life fund tax rate of 18%<br />

All numbers in today's money terms; 2% real investment growth as 50:50 income and capital growth<br />

NICs <strong>is</strong> 11% from Primary Threshold to UEL, 1% <strong>the</strong>reafter<br />

PLA = Purchased Life Annuity<br />

Thus, <strong>for</strong> example, a 20% taxpayer would have to make annual contributions of £3,399<br />

into a Life Fund MIP to accumulate £100,000 after 30 years. A 20 year PLA of £5,892<br />

(post-tax) could <strong>the</strong>n be purchased at retirement (assuming <strong>the</strong> saver remained a 20%<br />

taxpayer).<br />

The ISA funds are not used to buy an annuity because to do so would lose <strong>the</strong> tax-free<br />

status of ISA accruals and withdrawals. However, <strong>the</strong> £6,115 figure in Table 8 does require<br />

<strong>the</strong> saver to have perfect <strong>for</strong>esight as to how to run down h<strong>is</strong> assets over prec<strong>is</strong>ely 20<br />

years.<br />

63<br />

Scott<strong>is</strong>h Widows, UK Pensions Report 2009, June 2009.<br />

21