Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

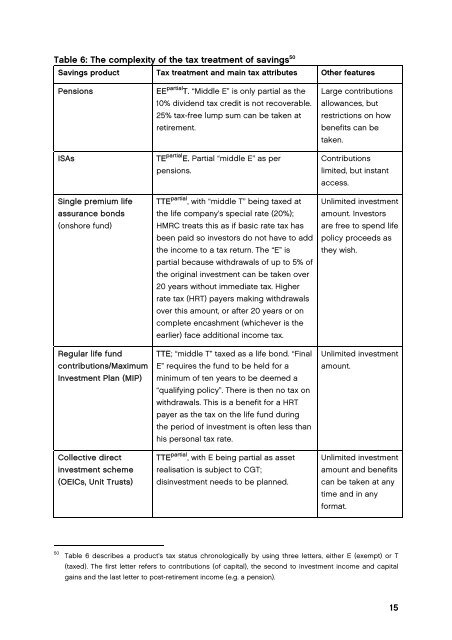

Table 6: The complexity of <strong>the</strong> tax treatment of savings 50<br />

Savings product Tax treatment and main tax attributes O<strong>the</strong>r features<br />

Pensions<br />

ISAs<br />

Single premium life<br />

assurance bonds<br />

(onshore fund)<br />

Regular life fund<br />

contributions/Maximum<br />

Investment Plan (MIP)<br />

Collective direct<br />

investment scheme<br />

(OEICs, Unit Trusts)<br />

EE partial T. “Middle E” <strong>is</strong> only partial as <strong>the</strong><br />

10% dividend tax credit <strong>is</strong> not recoverable.<br />

25% tax-free lump sum can be taken at<br />

retirement.<br />

TE partial E. Partial “middle E” as per<br />

pensions.<br />

TTE partial , with “middle T” being taxed at<br />

<strong>the</strong> life company’s special rate (20%);<br />

HMRC treats th<strong>is</strong> as if basic rate tax has<br />

been paid so investors do not have to add<br />

<strong>the</strong> income to a tax return. The “E” <strong>is</strong><br />

partial because withdrawals of up to 5% of<br />

<strong>the</strong> original investment can be taken over<br />

20 years without immediate tax. Higher<br />

rate tax (HRT) payers making withdrawals<br />

over th<strong>is</strong> amount, or after 20 years or on<br />

complete encashment (whichever <strong>is</strong> <strong>the</strong><br />

earlier) face additional income tax.<br />

TTE; “middle T” taxed as a life bond. “Final<br />

E” requires <strong>the</strong> fund to be held <strong>for</strong> a<br />

minimum of ten years to be deemed a<br />

“qualifying policy”. There <strong>is</strong> <strong>the</strong>n no tax on<br />

withdrawals. Th<strong>is</strong> <strong>is</strong> a benefit <strong>for</strong> a HRT<br />

payer as <strong>the</strong> tax on <strong>the</strong> life fund during<br />

<strong>the</strong> period of investment <strong>is</strong> often less than<br />

h<strong>is</strong> personal tax rate.<br />

TTE partial , with E being partial as asset<br />

real<strong>is</strong>ation <strong>is</strong> subject to CGT;<br />

d<strong>is</strong>investment needs to be planned.<br />

Large contributions<br />

allowances, but<br />

restrictions on how<br />

benefits can be<br />

taken.<br />

Contributions<br />

limited, but instant<br />

access.<br />

Unlimited investment<br />

amount. Investors<br />

are free to spend life<br />

policy proceeds as<br />

<strong>the</strong>y w<strong>is</strong>h.<br />

Unlimited investment<br />

amount.<br />

Unlimited investment<br />

amount and benefits<br />

can be taken at any<br />

time and in any<br />

<strong>for</strong>mat.<br />

50<br />

Table 6 describes a product’s tax status chronologically by using three letters, ei<strong>the</strong>r E (exempt) or T<br />

(taxed). The first letter refers to contributions (of capital), <strong>the</strong> second to investment income and capital<br />

gains and <strong>the</strong> last letter to post-retirement income (e.g. a pension).<br />

15