Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

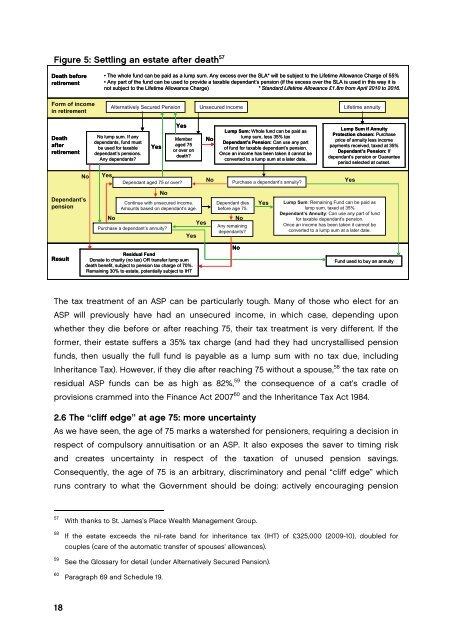

Figure 5: Settling an estate after death 57<br />

Death be<strong>for</strong>e<br />

retirement<br />

• The whole fund can be paid as a lump sum. Any excess over <strong>the</strong> SLA* will be subject to <strong>the</strong> Lifetime Allowance Charge of 55%<br />

• Any part of <strong>the</strong> fund can be used to provide a taxable dependant’s pension (if <strong>the</strong> excess over <strong>the</strong> SLA <strong>is</strong> used in th<strong>is</strong> way it <strong>is</strong><br />

not subject to <strong>the</strong> Lifetime Allowance Charge) * Standard Lifetime Allowance £1.8m from April 2010 to 2016.<br />

Form of income<br />

in retirement<br />

Alternatively Secured Pension<br />

Unsecured income<br />

Lifetime annuity<br />

Death<br />

after<br />

retirement<br />

No lump sum. If any<br />

dependants, fund must<br />

be used <strong>for</strong> taxable<br />

dependant’s pensions.<br />

Any dependants?<br />

Yes<br />

Yes<br />

Member<br />

aged 75<br />

or over on<br />

death?<br />

No<br />

Lump Sum: Whole fund can be paid as<br />

lump sum, less 35% tax<br />

Dependant’s Pension: Can use any part<br />

of fund <strong>for</strong> taxable dependant’s pension.<br />

Once an income has been taken it cannot be<br />

converted to a lump sum at a later date.<br />

Lump Sum if Annuity<br />

Protection chosen: Purchase<br />

price of annuity less income<br />

payments received, taxed at 35%<br />

Dependant’s Pension: If<br />

dependant’s pension or Guarantee<br />

period selected at outset.<br />

No<br />

Dependant’s<br />

pension<br />

Yes<br />

Dependant aged 75 or over?<br />

No<br />

Purchase a dependant’s annuity?<br />

Yes<br />

No<br />

Continue with unsecured income.<br />

Amounts based on dependant’s age.<br />

Dependant dies<br />

be<strong>for</strong>e age 75.<br />

Yes<br />

Lump Sum: Remaining Fund can be paid as<br />

lump sum, taxed at 35%<br />

Dependant’s Annuity: Can use any part of fund<br />

No<br />

No<br />

<strong>for</strong> taxable dependant’s pension.<br />

Yes<br />

Any remaining<br />

Once an income has been taken it cannot be<br />

Purchase a dependant’s annuity?<br />

dependants?<br />

converted to a lump sum at a later date.<br />

Yes<br />

Result<br />

Residual Fund<br />

Donate to charity (no tax) OR transfer lump sum<br />

death benefit, subject to pension tax charge of 70%.<br />

Remaining 30% to estate, potentially subject to IHT<br />

No<br />

Fund used to buy an annuity<br />

The tax treatment of an ASP can be particularly tough. Many of those who elect <strong>for</strong> an<br />

ASP will previously have had an unsecured income, in which case, depending upon<br />

whe<strong>the</strong>r <strong>the</strong>y die be<strong>for</strong>e or after reaching 75, <strong>the</strong>ir tax treatment <strong>is</strong> very different. If <strong>the</strong><br />

<strong>for</strong>mer, <strong>the</strong>ir estate suffers a 35% tax charge (and had <strong>the</strong>y had uncrystall<strong>is</strong>ed pension<br />

funds, <strong>the</strong>n usually <strong>the</strong> full fund <strong>is</strong> payable as a lump sum with no tax due, including<br />

Inheritance Tax). However, if <strong>the</strong>y die after reaching 75 without a spouse, 58 <strong>the</strong> tax rate on<br />

residual ASP funds can be as high as 82%, 59 <strong>the</strong> consequence of a cat’s cradle of<br />

prov<strong>is</strong>ions crammed into <strong>the</strong> Finance Act 2007 60 and <strong>the</strong> Inheritance Tax Act 1984.<br />

2.6 The “cliff edge” at age 75: more uncertainty<br />

As we have seen, <strong>the</strong> age of 75 marks a watershed <strong>for</strong> pensioners, requiring a dec<strong>is</strong>ion in<br />

respect of compulsory annuit<strong>is</strong>ation or an ASP. It also exposes <strong>the</strong> saver to timing r<strong>is</strong>k<br />

and creates uncertainty in respect of <strong>the</strong> taxation of unused pension savings.<br />

Consequently, <strong>the</strong> age of 75 <strong>is</strong> an arbitrary, d<strong>is</strong>criminatory and penal “cliff edge” which<br />

runs contrary to what <strong>the</strong> Government should be doing: actively encouraging pension<br />

57<br />

58<br />

59<br />

With thanks to St. James’s Place Wealth Management Group.<br />

If <strong>the</strong> estate exceeds <strong>the</strong> nil-rate band <strong>for</strong> inheritance tax (IHT) of £325,000 (2009-10), doubled <strong>for</strong><br />

couples (care of <strong>the</strong> automatic transfer of spouses’ allowances).<br />

See <strong>the</strong> Glossary <strong>for</strong> detail (under Alternatively Secured Pension).<br />

60 Paragraph 69 and Schedule 19.<br />

18