Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

savings by delivering a framework that <strong>is</strong> simple and flexible, permitting savers to make<br />

lifestyle choices with certainty. The recent Coalition Agreement (May 2010) does refer to<br />

ending compulsory annuit<strong>is</strong>ation.<br />

2.7 The unintuitive power of compounding<br />

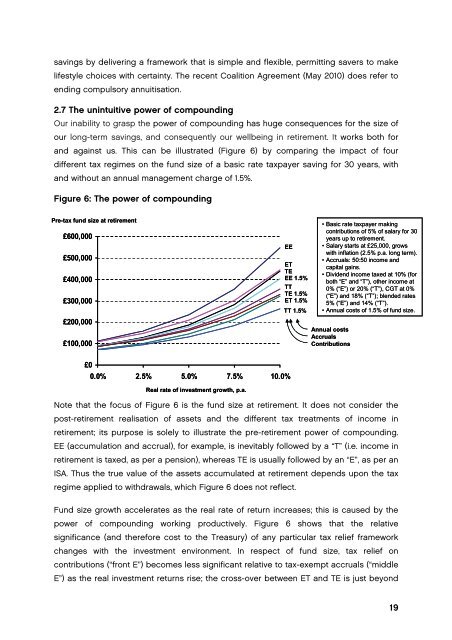

Our inability to grasp <strong>the</strong> power of compounding has huge consequences <strong>for</strong> <strong>the</strong> size of<br />

our long-term savings, and consequently our wellbeing in retirement. It works both <strong>for</strong><br />

and against us. Th<strong>is</strong> can be illustrated (Figure 6) by comparing <strong>the</strong> impact of four<br />

different tax regimes on <strong>the</strong> fund size of a basic rate taxpayer saving <strong>for</strong> 30 years, with<br />

and without an annual management charge of 1.5%.<br />

Figure 6: The power of compounding<br />

Pre-tax fund size at retirement<br />

£600,000<br />

£500,000<br />

£400,000<br />

£300,000<br />

£200,000<br />

£100,000<br />

EE<br />

ET<br />

TE<br />

EE 1.5%<br />

TT<br />

TE 1.5%<br />

ET 1.5%<br />

TT 1.5%<br />

• Basic rate taxpayer making<br />

contributions of 5% of salary <strong>for</strong> 30<br />

years up to retirement.<br />

• Salary starts at £25,000, grows<br />

with inflation (2.5% p.a. long term).<br />

• Accruals: 50:50 income and<br />

capital gains.<br />

• Dividend income taxed at 10% (<strong>for</strong><br />

both “E” and “T”), o<strong>the</strong>r income at<br />

0% (“E”) or 20% (“T”), CGT at 0%<br />

(“E”) and 18% (“T”); blended rates<br />

5% (“E”) and 14% (“T”).<br />

• Annual costs of 1.5% of fund size.<br />

Annual costs<br />

Accruals<br />

Contributions<br />

£0<br />

0.0% 2.5% 5.0% 7.5% 10.0%<br />

Real rate of investment growth, p.a.<br />

Note that <strong>the</strong> focus of Figure 6 <strong>is</strong> <strong>the</strong> fund size at retirement. It does not consider <strong>the</strong><br />

post-retirement real<strong>is</strong>ation of assets and <strong>the</strong> different tax treatments of income in<br />

retirement; its purpose <strong>is</strong> solely to illustrate <strong>the</strong> pre-retirement power of compounding.<br />

EE (accumulation and accrual), <strong>for</strong> example, <strong>is</strong> inevitably followed by a “T” (i.e. income in<br />

retirement <strong>is</strong> taxed, as per a pension), whereas TE <strong>is</strong> usually followed by an “E”, as per an<br />

ISA. Thus <strong>the</strong> true value of <strong>the</strong> assets accumulated at retirement depends upon <strong>the</strong> tax<br />

regime applied to withdrawals, which Figure 6 does not reflect.<br />

Fund size growth accelerates as <strong>the</strong> real rate of return increases; th<strong>is</strong> <strong>is</strong> caused by <strong>the</strong><br />

power of compounding working productively. Figure 6 shows that <strong>the</strong> relative<br />

significance (and <strong>the</strong>re<strong>for</strong>e cost to <strong>the</strong> Treasury) of any particular tax relief framework<br />

changes with <strong>the</strong> investment environment. In respect of fund size, tax relief on<br />

contributions (“front E”) becomes less significant relative to tax-exempt accruals (“middle<br />

E”) as <strong>the</strong> real investment returns r<strong>is</strong>e; <strong>the</strong> cross-over between ET and TE <strong>is</strong> just beyond<br />

19