Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Unlike pensions, ISAs do not attract upfront tax relief on contributions. However <strong>the</strong>y do<br />

provide similar tax relief on investment returns during <strong>the</strong>ir lifetime and also benefit from<br />

incurring no tax charge when <strong>the</strong> proceeds are withdrawn. As demonstrated later in th<strong>is</strong><br />

paper (Section 2.9), someone who expects to be an income or capital gains taxpayer in<br />

retirement may find that <strong>the</strong> tax relief on an ISA held to retirement <strong>is</strong> worth as much <strong>the</strong><br />

tax relief on a pension; 42 it <strong>is</strong> just deferred to when assets are real<strong>is</strong>ed ra<strong>the</strong>r than made<br />

explicit at <strong>the</strong> start. In addition, an ISA offers <strong>the</strong> added flexibility of having no restrictions<br />

on withdrawing funds. Conversely, retirement savings products do offer a 25% tax-free<br />

lump sum when <strong>the</strong> associated pension commences, partly to reward non-access to<br />

assets pre-retirement.<br />

The importance of ISAs within <strong>the</strong> savings arena cannot be overstated: <strong>the</strong>y are our most<br />

popular non-pension savings vehicle. More than 19 million people hold accounts that<br />

attracted over £37 billion of new savings in <strong>the</strong> last financial year, taking total assets to<br />

£275 billion 43 (more than 50% of <strong>the</strong> £450 billion of personal pension assets).<br />

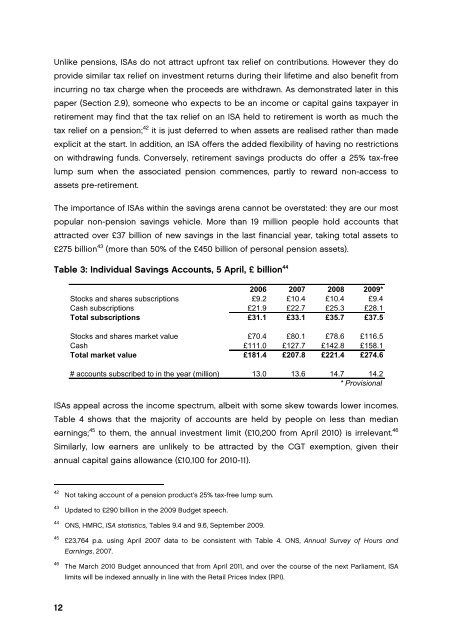

Table 3: Individual Savings Accounts, 5 April, £ billion 44<br />

2006 2007 2008 2009*<br />

Stocks and shares subscriptions £9.2 £10.4 £10.4 £9.4<br />

Cash subscriptions £21.9 £22.7 £25.3 £28.1<br />

Total subscriptions £31.1 £33.1 £35.7 £37.5<br />

Stocks and shares market value £70.4 £80.1 £78.6 £116.5<br />

Cash £111.0 £127.7 £142.8 £158.1<br />

Total market value £181.4 £207.8 £221.4 £274.6<br />

# accounts subscribed to in <strong>the</strong> year (million) 13.0 13.6 14.7 14.2<br />

* Prov<strong>is</strong>ional<br />

ISAs appeal across <strong>the</strong> income spectrum, albeit with some skew towards lower incomes.<br />

Table 4 shows that <strong>the</strong> majority of accounts are held by people on less than median<br />

earnings; 45 to <strong>the</strong>m, <strong>the</strong> annual investment limit (£10,200 from April 2010) <strong>is</strong> irrelevant. 46<br />

Similarly, low earners are unlikely to be attracted by <strong>the</strong> CGT exemption, given <strong>the</strong>ir<br />

annual capital gains allowance (£10,100 <strong>for</strong> 2010-11).<br />

42<br />

43<br />

44<br />

45<br />

46<br />

Not taking account of a pension product’s 25% tax-free lump sum.<br />

Updated to £290 billion in <strong>the</strong> 2009 Budget speech.<br />

ONS, HMRC, ISA stat<strong>is</strong>tics, Tables 9.4 and 9.6, September 2009.<br />

£23,764 p.a. using April 2007 data to be cons<strong>is</strong>tent with Table 4. ONS, Annual Survey of Hours and<br />

Earnings, 2007.<br />

The March 2010 Budget announced that from April 2011, and over <strong>the</strong> course of <strong>the</strong> next Parliament, ISA<br />

limits will be indexed annually in line with <strong>the</strong> Retail Prices Index (RPI).<br />

12