Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

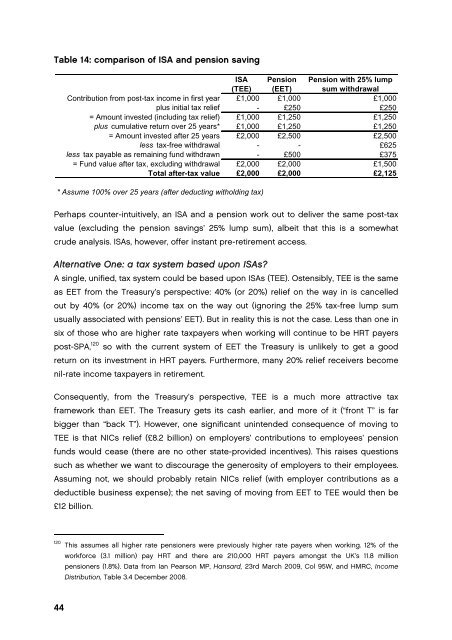

Table 14: compar<strong>is</strong>on of ISA and pension saving<br />

ISA Pension Pension with 25% lump<br />

(TEE) (EET) sum withdrawal<br />

Contribution from post-tax income in first year £1,000 £1,000 £1,000<br />

plus initial tax relief - £250 £250<br />

= Amount invested (including tax relief) £1,000 £1,250 £1,250<br />

plus cumulative return over 25 years* £1,000 £1,250 £1,250<br />

= Amount invested after 25 years £2,000 £2,500 £2,500<br />

less tax-free withdrawal - - £625<br />

less tax payable as remaining fund withdrawn - £500 £375<br />

= Fund value after tax, excluding withdrawal £2,000 £2,000 £1,500<br />

Total after-tax value £2,000 £2,000 £2,125<br />

* Assume 100% over 25 years (after deducting witholding tax)<br />

Perhaps counter-intuitively, an ISA and a pension work out to deliver <strong>the</strong> same post-tax<br />

value (excluding <strong>the</strong> pension savings’ 25% lump sum), albeit that th<strong>is</strong> <strong>is</strong> a somewhat<br />

crude analys<strong>is</strong>. ISAs, however, offer instant pre-retirement access.<br />

Alternative One: a tax system based upon ISAs?<br />

A single, unified, tax system could be based upon ISAs (TEE). Ostensibly, TEE <strong>is</strong> <strong>the</strong> same<br />

as EET from <strong>the</strong> Treasury’s perspective: 40% (or 20%) relief on <strong>the</strong> way in <strong>is</strong> cancelled<br />

out by 40% (or 20%) income tax on <strong>the</strong> way out (ignoring <strong>the</strong> 25% tax-free lump sum<br />

usually associated with pensions’ EET). But in reality th<strong>is</strong> <strong>is</strong> not <strong>the</strong> case. Less than one in<br />

six of those who are higher rate taxpayers when working will continue to be HRT payers<br />

post-SPA, 120 so with <strong>the</strong> current system of EET <strong>the</strong> Treasury <strong>is</strong> unlikely to get a good<br />

return on its investment in HRT payers. Fur<strong>the</strong>rmore, many 20% relief receivers become<br />

nil-rate income taxpayers in retirement.<br />

Consequently, from <strong>the</strong> Treasury’s perspective, TEE <strong>is</strong> a much more attractive tax<br />

framework than EET. The Treasury gets its cash earlier, and more of it (“front T” <strong>is</strong> far<br />

bigger than “back T”). However, one significant unintended consequence of moving to<br />

TEE <strong>is</strong> that NICs relief (£8.2 billion) on employers’ contributions to employees’ pension<br />

funds would cease (<strong>the</strong>re are no o<strong>the</strong>r state-provided incentives). Th<strong>is</strong> ra<strong>is</strong>es questions<br />

such as whe<strong>the</strong>r we want to d<strong>is</strong>courage <strong>the</strong> generosity of employers to <strong>the</strong>ir employees.<br />

Assuming not, we should probably retain NICs relief (with employer contributions as a<br />

deductible business expense); <strong>the</strong> net saving of moving from EET to TEE would <strong>the</strong>n be<br />

£12 billion.<br />

120 Th<strong>is</strong> assumes all higher rate pensioners were previously higher rate payers when working. 12% of <strong>the</strong><br />

work<strong>for</strong>ce (3.1 million) pay HRT and <strong>the</strong>re are 210,000 HRT payers amongst <strong>the</strong> UK’s 11.8 million<br />

pensioners (1.8%). Data from Ian Pearson MP, Hansard, 23rd March 2009, Col 95W, and HMRC, Income<br />

D<strong>is</strong>tribution, Table 3.4 December 2008.<br />

44