Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

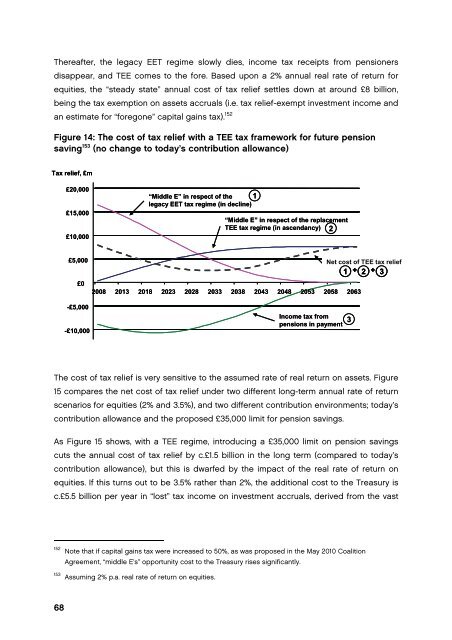

Thereafter, <strong>the</strong> legacy EET regime slowly dies, income tax receipts from pensioners<br />

d<strong>is</strong>appear, and TEE comes to <strong>the</strong> <strong>for</strong>e. Based upon a 2% annual real rate of return <strong>for</strong><br />

equities, <strong>the</strong> “steady state” annual cost of tax relief settles down at around £8 billion,<br />

being <strong>the</strong> tax exemption on assets accruals (i.e. tax relief-exempt investment income and<br />

an estimate <strong>for</strong> “<strong>for</strong>egone” capital gains tax). 152<br />

Figure 14: The cost of tax relief with a TEE tax framework <strong>for</strong> future pension<br />

saving 153 (no change to today’s contribution allowance)<br />

Tax relief, £m<br />

£20,000<br />

£15,000<br />

£10,000<br />

“Middle E” in respect of <strong>the</strong><br />

1<br />

legacy EET tax regime (in decline)<br />

“Middle E” in respect of <strong>the</strong> replacement<br />

TEE tax regime (in ascendancy)<br />

2<br />

£5,000<br />

£0<br />

2008 2013 2018 2023 2028 2033 2038 2043 2048 2053 2058 2063<br />

Net cost of TEE tax relief<br />

1 + 2<br />

+<br />

3<br />

-£5,000<br />

-£10,000<br />

Income tax from<br />

pensions in payment<br />

3<br />

The cost of tax relief <strong>is</strong> very sensitive to <strong>the</strong> assumed rate of real return on assets. Figure<br />

15 compares <strong>the</strong> net cost of tax relief under two different long-term annual rate of return<br />

scenarios <strong>for</strong> equities (2% and 3.5%), and two different contribution environments; today’s<br />

contribution allowance and <strong>the</strong> proposed £35,000 limit <strong>for</strong> pension savings.<br />

As Figure 15 shows, with a TEE regime, introducing a £35,000 limit on pension savings<br />

cuts <strong>the</strong> annual cost of tax relief by c.£1.5 billion in <strong>the</strong> long term (compared to today’s<br />

contribution allowance), but th<strong>is</strong> <strong>is</strong> dwarfed by <strong>the</strong> impact of <strong>the</strong> real rate of return on<br />

equities. If th<strong>is</strong> turns out to be 3.5% ra<strong>the</strong>r than 2%, <strong>the</strong> additional cost to <strong>the</strong> Treasury <strong>is</strong><br />

c.£5.5 billion per year in “lost” tax income on investment accruals, derived from <strong>the</strong> vast<br />

152 Note that if capital gains tax were increased to 50%, as was proposed in <strong>the</strong> May 2010 Coalition<br />

Agreement, “middle E’s” opportunity cost to <strong>the</strong> Treasury r<strong>is</strong>es significantly.<br />

153 Assuming 2% p.a. real rate of return on equities.<br />

68