Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

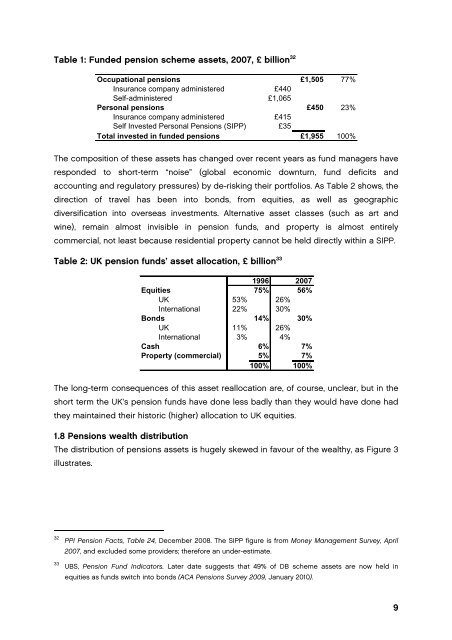

Table 1: Funded pension scheme assets, 2007, £ billion 32<br />

Occupational pensions £1,505 77%<br />

Insurance company admin<strong>is</strong>tered £440<br />

Self-admin<strong>is</strong>tered £1,065<br />

Personal pensions £450 23%<br />

Insurance company admin<strong>is</strong>tered £415<br />

Self Invested Personal Pensions (SIPP) £35<br />

Total invested in funded pensions £1,955 100%<br />

The composition of <strong>the</strong>se assets has changed over recent years as fund managers have<br />

responded to short-term “no<strong>is</strong>e” (global economic downturn, fund deficits and<br />

accounting and regulatory pressures) by de-r<strong>is</strong>king <strong>the</strong>ir portfolios. As Table 2 shows, <strong>the</strong><br />

direction of travel has been into bonds, from equities, as well as geographic<br />

diversification into overseas investments. Alternative asset classes (such as art and<br />

wine), remain almost inv<strong>is</strong>ible in pension funds, and property <strong>is</strong> almost entirely<br />

commercial, not least because residential property cannot be held directly within a SIPP.<br />

Table 2: UK pension funds’ asset allocation, £ billion 33<br />

1996 2007<br />

Equities 75% 56%<br />

UK 53% 26%<br />

International 22% 30%<br />

Bonds 14% 30%<br />

UK 11% 26%<br />

International 3% 4%<br />

Cash 6% 7%<br />

Property (commercial) 5% 7%<br />

100% 100%<br />

The long-term consequences of th<strong>is</strong> asset reallocation are, of course, unclear, but in <strong>the</strong><br />

short term <strong>the</strong> UK’s pension funds have done less badly than <strong>the</strong>y would have done had<br />

<strong>the</strong>y maintained <strong>the</strong>ir h<strong>is</strong>toric (higher) allocation to UK equities.<br />

1.8 Pensions wealth d<strong>is</strong>tribution<br />

The d<strong>is</strong>tribution of pensions assets <strong>is</strong> hugely skewed in favour of <strong>the</strong> wealthy, as Figure 3<br />

illustrates.<br />

32<br />

33<br />

PPI Pension Facts, Table 24, December 2008. The SIPP figure <strong>is</strong> from Money Management Survey, April<br />

2007, and excluded some providers; <strong>the</strong>re<strong>for</strong>e an under-estimate.<br />

UBS, Pension Fund Indicators. Later date suggests that 49% of DB scheme assets are now held in<br />

equities as funds switch into bonds (ACA Pensions Survey 2009, January 2010).<br />

9