Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

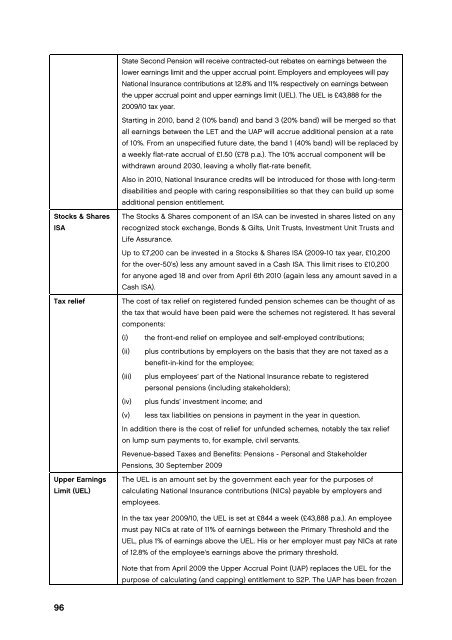

State Second Pension will receive contracted-out rebates on earnings between <strong>the</strong><br />

lower earnings limit and <strong>the</strong> upper accrual point. Employers and employees will pay<br />

National Insurance contributions at 12.8% and 11% respectively on earnings between<br />

<strong>the</strong> upper accrual point and upper earnings limit (UEL). The UEL <strong>is</strong> £43,888 <strong>for</strong> <strong>the</strong><br />

2009/10 tax year.<br />

Starting in 2010, band 2 (10% band) and band 3 (20% band) will be merged so that<br />

all earnings between <strong>the</strong> LET and <strong>the</strong> UAP will accrue additional pension at a rate<br />

of 10%. From an unspecified future date, <strong>the</strong> band 1 (40% band) will be replaced by<br />

a weekly flat-rate accrual of £1.50 (£78 p.a.). The 10% accrual component will be<br />

withdrawn around 2030, leaving a wholly flat-rate benefit.<br />

Also in 2010, National Insurance credits will be introduced <strong>for</strong> those with long-term<br />

d<strong>is</strong>abilities and people with caring responsibilities so that <strong>the</strong>y can build up some<br />

additional pension entitlement.<br />

Stocks & Shares<br />

ISA<br />

Tax relief<br />

Upper Earnings<br />

Limit (UEL)<br />

The Stocks & Shares component of an ISA can be invested in shares l<strong>is</strong>ted on any<br />

recognized stock exchange, Bonds & Gilts, Unit Trusts, Investment Unit Trusts and<br />

Life Assurance.<br />

Up to £7,200 can be invested in a Stocks & Shares ISA (2009-10 tax year, £10,200<br />

<strong>for</strong> <strong>the</strong> over-50’s) less any amount saved in a Cash ISA. Th<strong>is</strong> limit r<strong>is</strong>es to £10,200<br />

<strong>for</strong> anyone aged 18 and over from April 6th 2010 (again less any amount saved in a<br />

Cash ISA).<br />

The cost of tax relief on reg<strong>is</strong>tered funded pension schemes can be thought of as<br />

<strong>the</strong> tax that would have been paid were <strong>the</strong> schemes not reg<strong>is</strong>tered. It has several<br />

components:<br />

(i) <strong>the</strong> front-end relief on employee and self-employed contributions;<br />

(ii) plus contributions by employers on <strong>the</strong> bas<strong>is</strong> that <strong>the</strong>y are not taxed as a<br />

benefit-in-kind <strong>for</strong> <strong>the</strong> employee;<br />

(iii) plus employees’ part of <strong>the</strong> National Insurance rebate to reg<strong>is</strong>tered<br />

personal pensions (including stakeholders);<br />

(iv) plus funds’ investment income; and<br />

(v) less tax liabilities on pensions in payment in <strong>the</strong> year in question.<br />

In addition <strong>the</strong>re <strong>is</strong> <strong>the</strong> cost of relief <strong>for</strong> unfunded schemes, notably <strong>the</strong> tax relief<br />

on lump sum payments to, <strong>for</strong> example, civil servants.<br />

Revenue-based Taxes and Benefits: Pensions - Personal and Stakeholder<br />

Pensions, 30 September 2009<br />

The UEL <strong>is</strong> an amount set by <strong>the</strong> government each year <strong>for</strong> <strong>the</strong> purposes of<br />

calculating National Insurance contributions (NICs) payable by employers and<br />

employees.<br />

In <strong>the</strong> tax year 2009/10, <strong>the</strong> UEL <strong>is</strong> set at £844 a week (£43,888 p.a.). An employee<br />

must pay NICs at rate of 11% of earnings between <strong>the</strong> Primary Threshold and <strong>the</strong><br />

UEL, plus 1% of earnings above <strong>the</strong> UEL. H<strong>is</strong> or her employer must pay NICs at rate<br />

of 12.8% of <strong>the</strong> employee's earnings above <strong>the</strong> primary threshold.<br />

Note that from April 2009 <strong>the</strong> Upper Accrual Point (UAP) replaces <strong>the</strong> UEL <strong>for</strong> <strong>the</strong><br />

purpose of calculating (and capping) entitlement to S2P. The UAP has been frozen<br />

96