Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

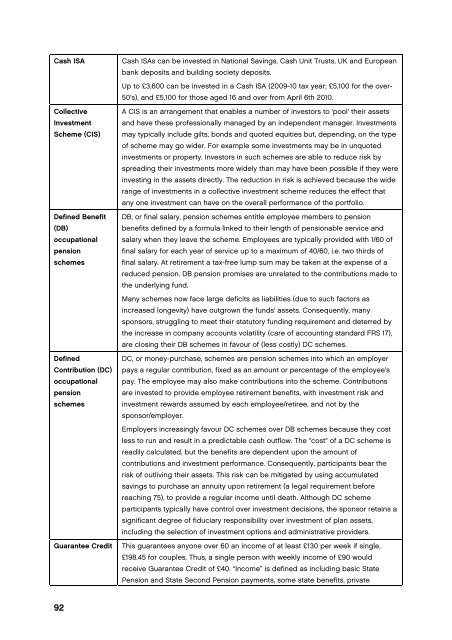

Cash ISA<br />

Collective<br />

Investment<br />

Scheme (CIS)<br />

Defined Benefit<br />

(DB)<br />

occupational<br />

pension<br />

schemes<br />

Defined<br />

Contribution (DC)<br />

occupational<br />

pension<br />

schemes<br />

Guarantee Credit<br />

Cash ISAs can be invested in National Savings, Cash Unit Trusts, UK and European<br />

bank deposits and building society deposits.<br />

Up to £3,600 can be invested in a Cash ISA (2009-10 tax year; £5,100 <strong>for</strong> <strong>the</strong> over-<br />

50’s), and £5,100 <strong>for</strong> those aged 16 and over from April 6th 2010.<br />

A CIS <strong>is</strong> an arrangement that enables a number of investors to 'pool' <strong>the</strong>ir assets<br />

and have <strong>the</strong>se professionally managed by an independent manager. Investments<br />

may typically include gilts, bonds and quoted equities but, depending, on <strong>the</strong> type<br />

of scheme may go wider. For example some investments may be in unquoted<br />

investments or property. Investors in such schemes are able to reduce r<strong>is</strong>k by<br />

spreading <strong>the</strong>ir investments more widely than may have been possible if <strong>the</strong>y were<br />

investing in <strong>the</strong> assets directly. The reduction in r<strong>is</strong>k <strong>is</strong> achieved because <strong>the</strong> wide<br />

range of investments in a collective investment scheme reduces <strong>the</strong> effect that<br />

any one investment can have on <strong>the</strong> overall per<strong>for</strong>mance of <strong>the</strong> portfolio.<br />

DB, or final salary, pension schemes entitle employee members to pension<br />

benefits defined by a <strong>for</strong>mula linked to <strong>the</strong>ir length of pensionable service and<br />

salary when <strong>the</strong>y leave <strong>the</strong> scheme. Employees are typically provided with 1/60 of<br />

final salary <strong>for</strong> each year of service up to a maximum of 40/60, i.e. two thirds of<br />

final salary. At retirement a tax-free lump sum may be taken at <strong>the</strong> expense of a<br />

reduced pension. DB pension prom<strong>is</strong>es are unrelated to <strong>the</strong> contributions made to<br />

<strong>the</strong> underlying fund.<br />

Many schemes now face large deficits as liabilities (due to such factors as<br />

increased longevity) have outgrown <strong>the</strong> funds' assets. Consequently, many<br />

sponsors, struggling to meet <strong>the</strong>ir statutory funding requirement and deterred by<br />

<strong>the</strong> increase in company accounts volatility (care of accounting standard FRS 17),<br />

are closing <strong>the</strong>ir DB schemes in favour of (less costly) DC schemes.<br />

DC, or money-purchase, schemes are pension schemes into which an employer<br />

pays a regular contribution, fixed as an amount or percentage of <strong>the</strong> employee's<br />

pay. The employee may also make contributions into <strong>the</strong> scheme. Contributions<br />

are invested to provide employee retirement benefits, with investment r<strong>is</strong>k and<br />

investment rewards assumed by each employee/retiree, and not by <strong>the</strong><br />

sponsor/employer.<br />

Employers increasingly favour DC schemes over DB schemes because <strong>the</strong>y cost<br />

less to run and result in a predictable cash outflow. The "cost" of a DC scheme <strong>is</strong><br />

readily calculated, but <strong>the</strong> benefits are dependent upon <strong>the</strong> amount of<br />

contributions and investment per<strong>for</strong>mance. Consequently, participants bear <strong>the</strong><br />

r<strong>is</strong>k of outliving <strong>the</strong>ir assets. Th<strong>is</strong> r<strong>is</strong>k can be mitigated by using accumulated<br />

savings to purchase an annuity upon retirement (a legal requirement be<strong>for</strong>e<br />

reaching 75), to provide a regular income until death. Although DC scheme<br />

participants typically have control over investment dec<strong>is</strong>ions, <strong>the</strong> sponsor retains a<br />

significant degree of fiduciary responsibility over investment of plan assets,<br />

including <strong>the</strong> selection of investment options and admin<strong>is</strong>trative providers.<br />

Th<strong>is</strong> guarantees anyone over 60 an income of at least £130 per week if single,<br />

£198.45 <strong>for</strong> couples. Thus, a single person with weekly income of £90 would<br />

receive Guarantee Credit of £40. “Income” <strong>is</strong> defined as including basic State<br />

Pension and State Second Pension payments, some state benefits, private<br />

92