Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

would subsequently be treated as pension assets <strong>for</strong> tax purposes, but those renominated<br />

at retirement should not be eligible <strong>for</strong> pension savings’ 25% tax-free lump sum.<br />

Th<strong>is</strong> feature provides ISA savers with an ability to act on <strong>the</strong> benefit of hindsight, severing<br />

<strong>the</strong> current link between <strong>the</strong> year in which pension savings are made and <strong>the</strong> ability to<br />

claim tax relief in respect of tax paid in that same year. Th<strong>is</strong> may prove particularly<br />

valuable to those who have accumulated some ISA savings but may not have made<br />

contributions to a pension because <strong>the</strong>y were not working (and not paying tax). Women,<br />

in particular, may have had career breaks to have children (and subsequently care <strong>for</strong><br />

<strong>the</strong>m), or <strong>the</strong>y have been caring <strong>for</strong> elderly relatives. There are also likely to be some<br />

people who chose not to save in a pension because <strong>the</strong>y did not trust <strong>the</strong>m, or to whom<br />

retirement always seemed to be just too far away.<br />

ISA asset re-nomination, not sale and purchase<br />

Permitting ISA assets to be re-nominated as pensions savings (perhaps on a lifetime savings<br />

plat<strong>for</strong>m) means that savers would not incur <strong>the</strong> costs associated with selling ISA assets and<br />

<strong>the</strong>n repurchasing <strong>the</strong>m within a pension savings wrapper. Th<strong>is</strong> would represent a<br />

simplification, and would rein<strong>for</strong>ce <strong>the</strong> close proximity of ISAs and pension savings. The<br />

standard rate of tax relief should be added automatically to <strong>the</strong> pension savings.<br />

Early access to pension savings<br />

Proposals 5 and 11 introduce <strong>the</strong> ability to access, pre-retirement, up to 25% of assets<br />

locked into a pension savings wrapper. Th<strong>is</strong> should benefit savers who may be facing<br />

cashflow difficulties, but have significant accumulated pensions savings. They could <strong>the</strong>n<br />

perhaps avoid home repossession, pay health-related costs or meet o<strong>the</strong>r, perhaps<br />

unexpected, expenses.<br />

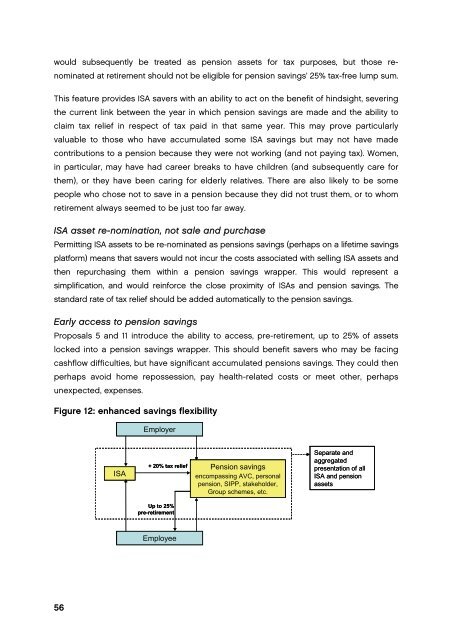

Figure 12: enhanced savings flexibility<br />

Employer<br />

ISA<br />

+ 20% tax relief<br />

Pension savings<br />

encompassing AVC, personal<br />

pension, SIPP, stakeholder,<br />

Group schemes, etc.<br />

Separate and<br />

aggregated<br />

presentation of all<br />

ISA and pension<br />

assets<br />

Up to 25%<br />

pre-retirement<br />

Employee<br />

56