Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

Simplification is the key - Centre for Policy Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

personal pensions including group-based schemes (GPP), stakeholder and some SIPPS<br />

(HMRC does not receive SIPP returns from all providers; perhaps ano<strong>the</strong>r £3 billion). 24<br />

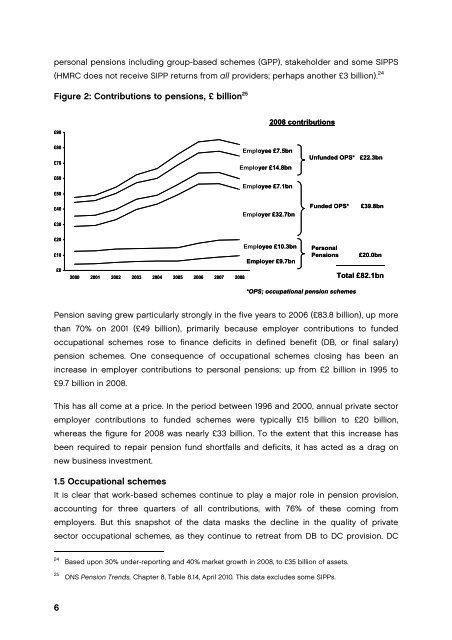

Figure 2: Contributions to pensions, £ billion 25<br />

£90<br />

2008 contributions<br />

£80<br />

£70<br />

£60<br />

£50<br />

Employee £7.5bn<br />

Employer £14.8bn<br />

Employee £7.1bn<br />

Unfunded OPS* £22.3bn<br />

£40<br />

Employer £32.7bn<br />

Funded OPS*<br />

£39.8bn<br />

£30<br />

£20<br />

£10<br />

£0<br />

Employee £10.3bn<br />

Employer £9.7bn<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008<br />

Personal<br />

Pensions<br />

£20.0bn<br />

Total £82.1bn<br />

*OPS; occupational pension schemes<br />

Pension saving grew particularly strongly in <strong>the</strong> five years to 2006 (£83.8 billion), up more<br />

than 70% on 2001 (£49 billion), primarily because employer contributions to funded<br />

occupational schemes rose to finance deficits in defined benefit (DB, or final salary)<br />

pension schemes. One consequence of occupational schemes closing has been an<br />

increase in employer contributions to personal pensions; up from £2 billion in 1995 to<br />

£9.7 billion in 2008.<br />

Th<strong>is</strong> has all come at a price. In <strong>the</strong> period between 1996 and 2000, annual private sector<br />

employer contributions to funded schemes were typically £15 billion to £20 billion,<br />

whereas <strong>the</strong> figure <strong>for</strong> 2008 was nearly £33 billion. To <strong>the</strong> extent that th<strong>is</strong> increase has<br />

been required to repair pension fund shortfalls and deficits, it has acted as a drag on<br />

new business investment.<br />

1.5 Occupational schemes<br />

It <strong>is</strong> clear that work-based schemes continue to play a major role in pension prov<strong>is</strong>ion,<br />

accounting <strong>for</strong> three quarters of all contributions, with 76% of <strong>the</strong>se coming from<br />

employers. But th<strong>is</strong> snapshot of <strong>the</strong> data masks <strong>the</strong> decline in <strong>the</strong> quality of private<br />

sector occupational schemes, as <strong>the</strong>y continue to retreat from DB to DC prov<strong>is</strong>ion. DC<br />

24<br />

25<br />

Based upon 30% under-reporting and 40% market growth in 2008, to £35 billion of assets.<br />

ONS Pension Trends, Chapter 8, Table 8.14, April 2010. Th<strong>is</strong> data excludes some SIPPs.<br />

6