AGENDA MARCH 9, 2011 5:00 PM 1. Meeting called to order 2. A ...

AGENDA MARCH 9, 2011 5:00 PM 1. Meeting called to order 2. A ...

AGENDA MARCH 9, 2011 5:00 PM 1. Meeting called to order 2. A ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

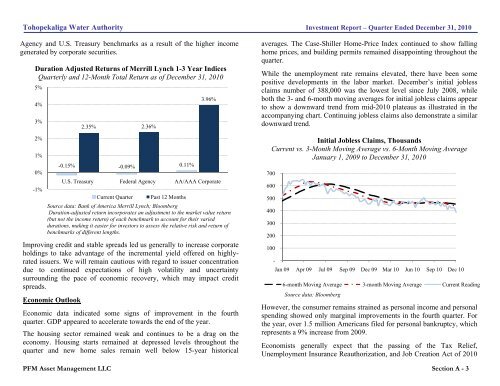

Tohopekaliga Water Authority Investment Report – Quarter Ended December 31, 2010Agency and U.S. Treasury benchmarks as a result of the higher incomegenerated by corporate securities.Duration Adjusted Returns of Merrill Lynch 1-3 Year IndicesQuarterly and 12-Month Total Return as of December 31, 20105%4%3%2%1%0%-1%Improving credit and stable spreads led us generally <strong>to</strong> increase corporateholdings <strong>to</strong> take advantage of the incremental yield offered on highlyratedissuers. We will remain cautious with regard <strong>to</strong> issuer concentrationdue <strong>to</strong> continued expectations of high volatility and uncertaintysurrounding the pace of economic recovery, which may impact creditspreads.Economic Outlook<strong>2.</strong>35% <strong>2.</strong>36%-0.15% -0.09% 0.11%3.96%U.S. Treasury Federal Agency AA/AAA CorporateCurrent QuarterPast 12 MonthsSource data: Bank of America Merrill Lynch; BloombergDuration-adjusted return incorporates an adjustment <strong>to</strong> the market value return(but not the income return) of each benchmark <strong>to</strong> account for their varieddurations, making it easier for inves<strong>to</strong>rs <strong>to</strong> assess the relative risk and return ofbenchmarks of different lengths.Economic data indicated some signs of improvement in the fourthquarter. GDP appeared <strong>to</strong> accelerate <strong>to</strong>wards the end of the year.The housing sec<strong>to</strong>r remained weak and continues <strong>to</strong> be a drag on theeconomy. Housing starts remained at depressed levels throughout thequarter and new home sales remain well below 15-year his<strong>to</strong>ricalaverages. The Case-Shiller Home-Price Index continued <strong>to</strong> show fallinghome prices, and building permits remained disappointing throughout thequarter.While the unemployment rate remains elevated, there have been somepositive developments in the labor market. December’s initial joblessclaims number of 388,<strong>00</strong>0 was the lowest level since July 2<strong>00</strong>8, whileboth the 3- and 6-month moving averages for initial jobless claims appear<strong>to</strong> show a downward trend from mid-2010 plateaus as illustrated in theaccompanying chart. Continuing jobless claims also demonstrate a similardownward trend.Initial Jobless Claims, ThousandsCurrent vs. 3-Month Moving Average vs. 6-Month Moving AverageJanuary 1, 2<strong>00</strong>9 <strong>to</strong> December 31, 20107<strong>00</strong>6<strong>00</strong>5<strong>00</strong>4<strong>00</strong>3<strong>00</strong>2<strong>00</strong>1<strong>00</strong>-Jan 09 Apr 09 Jul 09 Sep 09 Dec 09 Mar 10 Jun 10 Sep 10 Dec 106-month Moving Average 3-month Moving Average Current ReadingSource data: BloombergHowever, the consumer remains strained as personal income and personalspending showed only marginal improvements in the fourth quarter. Forthe year, over <strong>1.</strong>5 million Americans filed for personal bankruptcy, whichrepresents a 9% increase from 2<strong>00</strong>9.Economists generally expect that the passing of the Tax Relief,Unemployment Insurance Reauthorization, and Job Creation Act of 2010PFM Asset Management LLC Section A - 3