Analysis of the Operation and Financial Condition of the Enterprise

Analysis of the Operation and Financial Condition of the Enterprise

Analysis of the Operation and Financial Condition of the Enterprise

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

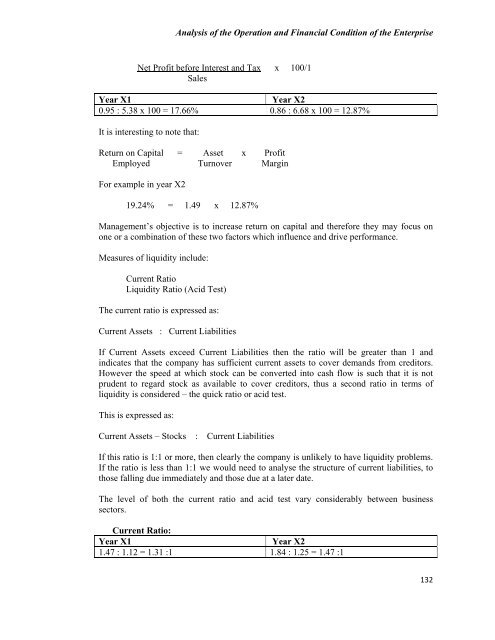

<strong>Analysis</strong> <strong>of</strong> <strong>the</strong> <strong>Operation</strong> <strong>and</strong> <strong>Financial</strong> <strong>Condition</strong> <strong>of</strong> <strong>the</strong> <strong>Enterprise</strong>Net Pr<strong>of</strong>it before Interest <strong>and</strong> Tax x 100/1SalesYear X1Year X20.95 : 5.38 x 100 = 17.66% 0.86 : 6.68 x 100 = 12.87%It is interesting to note that:Return on Capital = Asset x Pr<strong>of</strong>itEmployed Turnover MarginFor example in year X219.24% = 1.49 x 12.87%Management’s objective is to increase return on capital <strong>and</strong> <strong>the</strong>refore <strong>the</strong>y may focus onone or a combination <strong>of</strong> <strong>the</strong>se two factors which influence <strong>and</strong> drive performance.Measures <strong>of</strong> liquidity include:Current RatioLiquidity Ratio (Acid Test)The current ratio is expressed as:Current Assets : Current LiabilitiesIf Current Assets exceed Current Liabilities <strong>the</strong>n <strong>the</strong> ratio will be greater than 1 <strong>and</strong>indicates that <strong>the</strong> company has sufficient current assets to cover dem<strong>and</strong>s from creditors.However <strong>the</strong> speed at which stock can be converted into cash flow is such that it is notprudent to regard stock as available to cover creditors, thus a second ratio in terms <strong>of</strong>liquidity is considered – <strong>the</strong> quick ratio or acid test.This is expressed as:Current Assets – Stocks: Current LiabilitiesIf this ratio is 1:1 or more, <strong>the</strong>n clearly <strong>the</strong> company is unlikely to have liquidity problems.If <strong>the</strong> ratio is less than 1:1 we would need to analyse <strong>the</strong> structure <strong>of</strong> current liabilities, tothose falling due immediately <strong>and</strong> those due at a later date.The level <strong>of</strong> both <strong>the</strong> current ratio <strong>and</strong> acid test vary considerably between businesssectors.Current Ratio:Year X1Year X21.47 : 1.12 = 1.31 :1 1.84 : 1.25 = 1.47 :1132