Analysis of the Operation and Financial Condition of the Enterprise

Analysis of the Operation and Financial Condition of the Enterprise

Analysis of the Operation and Financial Condition of the Enterprise

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

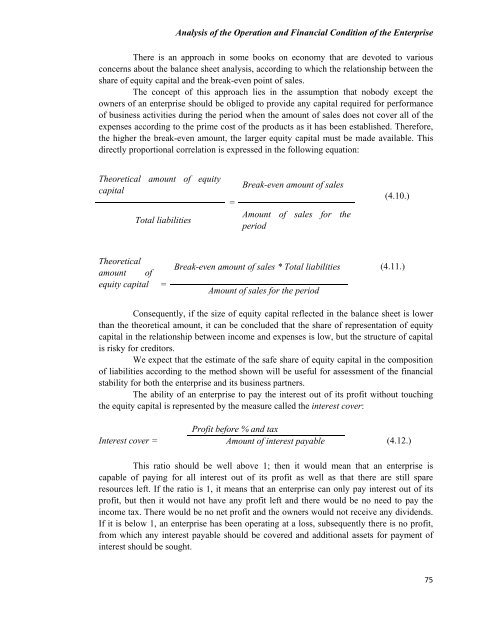

<strong>Analysis</strong> <strong>of</strong> <strong>the</strong> <strong>Operation</strong> <strong>and</strong> <strong>Financial</strong> <strong>Condition</strong> <strong>of</strong> <strong>the</strong> <strong>Enterprise</strong>There is an approach in some books on economy that are devoted to variousconcerns about <strong>the</strong> balance sheet analysis, according to which <strong>the</strong> relationship between <strong>the</strong>share <strong>of</strong> equity capital <strong>and</strong> <strong>the</strong> break-even point <strong>of</strong> sales.The concept <strong>of</strong> this approach lies in <strong>the</strong> assumption that nobody except <strong>the</strong>owners <strong>of</strong> an enterprise should be obliged to provide any capital required for performance<strong>of</strong> business activities during <strong>the</strong> period when <strong>the</strong> amount <strong>of</strong> sales does not cover all <strong>of</strong> <strong>the</strong>expenses according to <strong>the</strong> prime cost <strong>of</strong> <strong>the</strong> products as it has been established. Therefore,<strong>the</strong> higher <strong>the</strong> break-even amount, <strong>the</strong> larger equity capital must be made available. Thisdirectly proportional correlation is expressed in <strong>the</strong> following equation:Theoretical amount <strong>of</strong> equitycapitalTotal liabilities=Break-even amount <strong>of</strong> salesAmount <strong>of</strong> sales for <strong>the</strong>period(4.10.)Theoreticalamount <strong>of</strong>equity capital=Break-even amount <strong>of</strong> sales * Total liabilitiesAmount <strong>of</strong> sales for <strong>the</strong> period(4.11.)Consequently, if <strong>the</strong> size <strong>of</strong> equity capital reflected in <strong>the</strong> balance sheet is lowerthan <strong>the</strong> <strong>the</strong>oretical amount, it can be concluded that <strong>the</strong> share <strong>of</strong> representation <strong>of</strong> equitycapital in <strong>the</strong> relationship between income <strong>and</strong> expenses is low, but <strong>the</strong> structure <strong>of</strong> capitalis risky for creditors.We expect that <strong>the</strong> estimate <strong>of</strong> <strong>the</strong> safe share <strong>of</strong> equity capital in <strong>the</strong> composition<strong>of</strong> liabilities according to <strong>the</strong> method shown will be useful for assessment <strong>of</strong> <strong>the</strong> financialstability for both <strong>the</strong> enterprise <strong>and</strong> its business partners.The ability <strong>of</strong> an enterprise to pay <strong>the</strong> interest out <strong>of</strong> its pr<strong>of</strong>it without touching<strong>the</strong> equity capital is represented by <strong>the</strong> measure called <strong>the</strong> interest cover:Interest cover =Pr<strong>of</strong>it before % <strong>and</strong> taxAmount <strong>of</strong> interest payable(4.12.)This ratio should be well above 1; <strong>the</strong>n it would mean that an enterprise iscapable <strong>of</strong> paying for all interest out <strong>of</strong> its pr<strong>of</strong>it as well as that <strong>the</strong>re are still spareresources left. If <strong>the</strong> ratio is 1, it means that an enterprise can only pay interest out <strong>of</strong> itspr<strong>of</strong>it, but <strong>the</strong>n it would not have any pr<strong>of</strong>it left <strong>and</strong> <strong>the</strong>re would be no need to pay <strong>the</strong>income tax. There would be no net pr<strong>of</strong>it <strong>and</strong> <strong>the</strong> owners would not receive any dividends.If it is below 1, an enterprise has been operating at a loss, subsequently <strong>the</strong>re is no pr<strong>of</strong>it,from which any interest payable should be covered <strong>and</strong> additional assets for payment <strong>of</strong>interest should be sought.75