Analysis of the Operation and Financial Condition of the Enterprise

Analysis of the Operation and Financial Condition of the Enterprise

Analysis of the Operation and Financial Condition of the Enterprise

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

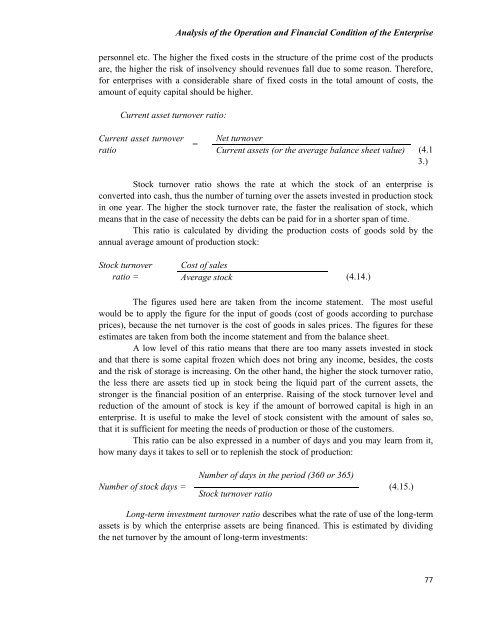

<strong>Analysis</strong> <strong>of</strong> <strong>the</strong> <strong>Operation</strong> <strong>and</strong> <strong>Financial</strong> <strong>Condition</strong> <strong>of</strong> <strong>the</strong> <strong>Enterprise</strong>personnel etc. The higher <strong>the</strong> fixed costs in <strong>the</strong> structure <strong>of</strong> <strong>the</strong> prime cost <strong>of</strong> <strong>the</strong> productsare, <strong>the</strong> higher <strong>the</strong> risk <strong>of</strong> insolvency should revenues fall due to some reason. Therefore,for enterprises with a considerable share <strong>of</strong> fixed costs in <strong>the</strong> total amount <strong>of</strong> costs, <strong>the</strong>amount <strong>of</strong> equity capital should be higher.Current asset turnover ratio:Current asset turnoverratio=Net turnoverCurrent assets (or <strong>the</strong> average balance sheet value)(4.13.)Stock turnover ratio shows <strong>the</strong> rate at which <strong>the</strong> stock <strong>of</strong> an enterprise isconverted into cash, thus <strong>the</strong> number <strong>of</strong> turning over <strong>the</strong> assets invested in production stockin one year. The higher <strong>the</strong> stock turnover rate, <strong>the</strong> faster <strong>the</strong> realisation <strong>of</strong> stock, whichmeans that in <strong>the</strong> case <strong>of</strong> necessity <strong>the</strong> debts can be paid for in a shorter span <strong>of</strong> time.This ratio is calculated by dividing <strong>the</strong> production costs <strong>of</strong> goods sold by <strong>the</strong>annual average amount <strong>of</strong> production stock:Stock turnoverratio =Cost <strong>of</strong> salesAverage stock(4.14.)The figures used here are taken from <strong>the</strong> income statement. The most usefulwould be to apply <strong>the</strong> figure for <strong>the</strong> input <strong>of</strong> goods (cost <strong>of</strong> goods according to purchaseprices), because <strong>the</strong> net turnover is <strong>the</strong> cost <strong>of</strong> goods in sales prices. The figures for <strong>the</strong>seestimates are taken from both <strong>the</strong> income statement <strong>and</strong> from <strong>the</strong> balance sheet.A low level <strong>of</strong> this ratio means that <strong>the</strong>re are too many assets invested in stock<strong>and</strong> that <strong>the</strong>re is some capital frozen which does not bring any income, besides, <strong>the</strong> costs<strong>and</strong> <strong>the</strong> risk <strong>of</strong> storage is increasing. On <strong>the</strong> o<strong>the</strong>r h<strong>and</strong>, <strong>the</strong> higher <strong>the</strong> stock turnover ratio,<strong>the</strong> less <strong>the</strong>re are assets tied up in stock being <strong>the</strong> liquid part <strong>of</strong> <strong>the</strong> current assets, <strong>the</strong>stronger is <strong>the</strong> financial position <strong>of</strong> an enterprise. Raising <strong>of</strong> <strong>the</strong> stock turnover level <strong>and</strong>reduction <strong>of</strong> <strong>the</strong> amount <strong>of</strong> stock is key if <strong>the</strong> amount <strong>of</strong> borrowed capital is high in anenterprise. It is useful to make <strong>the</strong> level <strong>of</strong> stock consistent with <strong>the</strong> amount <strong>of</strong> sales so,that it is sufficient for meeting <strong>the</strong> needs <strong>of</strong> production or those <strong>of</strong> <strong>the</strong> customers.This ratio can be also expressed in a number <strong>of</strong> days <strong>and</strong> you may learn from it,how many days it takes to sell or to replenish <strong>the</strong> stock <strong>of</strong> production:Number <strong>of</strong> stock days =Number <strong>of</strong> days in <strong>the</strong> period (360 or 365)Stock turnover ratio(4.15.)Long-term investment turnover ratio describes what <strong>the</strong> rate <strong>of</strong> use <strong>of</strong> <strong>the</strong> long-termassets is by which <strong>the</strong> enterprise assets are being financed. This is estimated by dividing<strong>the</strong> net turnover by <strong>the</strong> amount <strong>of</strong> long-term investments:77