Alternative Construction Research Guide - GCCDS

Alternative Construction Research Guide - GCCDS

Alternative Construction Research Guide - GCCDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

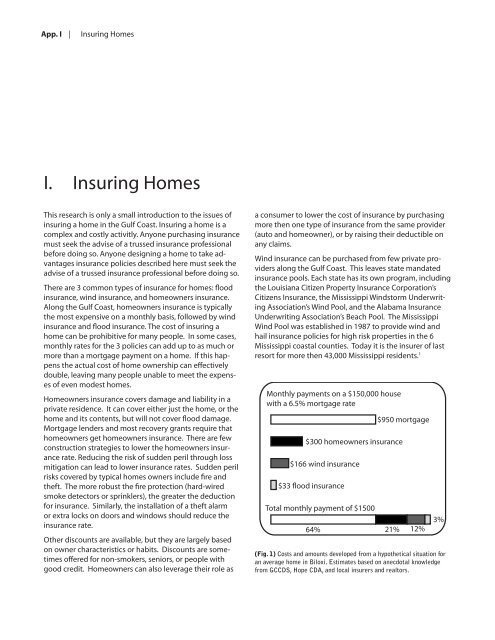

App. I | Insuring HomesI. Insuring HomesThis research is only a small introduction to the issues ofinsuring a home in the Gulf Coast. Insuring a home is acomplex and costly activitly. Anyone purchasing insurancemust seek the advise of a trussed insurance professionalbefore doing so. Anyone designing a home to take advantagesinsurance policies described here must seek theadvise of a trussed insurance professional before doing so.There are 3 common types of insurance for homes: floodinsurance, wind insurance, and homeowners insurance.Along the Gulf Coast, homeowners insurance is typicallythe most expensive on a monthly basis, followed by windinsurance and flood insurance. The cost of insuring ahome can be prohibitive for many people. In some cases,monthly rates for the 3 policies can add up to as much ormore than a mortgage payment on a home. If this happensthe actual cost of home ownership can effectivelydouble, leaving many people unable to meet the expensesof even modest homes.Homeowners insurance covers damage and liability in aprivate residence. It can cover either just the home, or thehome and its contents, but will not cover flood damage.Mortgage lenders and most recovery grants require thathomeowners get homeowners insurance. There are fewconstruction strategies to lower the homeowners insurancerate. Reducing the risk of sudden peril through lossmitigation can lead to lower insurance rates. Sudden perilrisks covered by typical homes owners include fire andtheft. The more robust the fire protection (hard-wiredsmoke detectors or sprinklers), the greater the deductionfor insurance. Similarly, the installation of a theft alarmor extra locks on doors and windows should reduce theinsurance rate.Other discounts are available, but they are largely basedon owner characteristics or habits. Discounts are sometimesoffered for non-smokers, seniors, or people withgood credit. Homeowners can also leverage their role asa consumer to lower the cost of insurance by purchasingmore then one type of insurance from the same provider(auto and homeowner), or by raising their deductible onany claims.Wind insurance can be purchased from few private providersalong the Gulf Coast. This leaves state mandatedinsurance pools. Each state has its own program, includingthe Louisiana Citizen Property Insurance Corporation’sCitizens Insurance, the Mississippi Windstorm UnderwritingAssociation’s Wind Pool, and the Alabama InsuranceUnderwriting Association’s Beach Pool. The MississippiWind Pool was established in 1987 to provide wind andhail insurance policies for high risk properties in the 6Mississippi coastal counties. Today it is the insurer of lastresort for more then 43,000 Mississippi residents. 1Monthly payments on a $150,000 housewith a 6.5% mortgage rate$300 homeowners insurance$166 wind insurance$33 flood insuranceTotal monthly payment of $1500$950 mortgage64% 21% 12%3%(Fig. 1) Costs and amounts developed from a hypothetical situation foran average home in Biloxi. Estimates based on anecdotal knowledgefrom <strong>GCCDS</strong>, Hope CDA, and local insurers and realtors.