A1A - EIL Tender portal

A1A - EIL Tender portal

A1A - EIL Tender portal

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

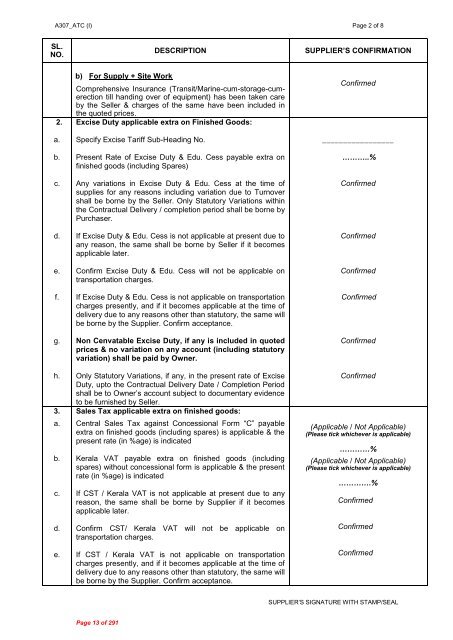

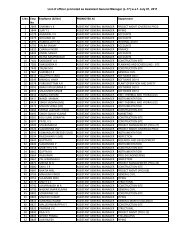

A307_ATC (I) Page 2 of 8<br />

SL.<br />

NO.<br />

DESCRIPTION<br />

SUPPLIER’S CONFIRMATION<br />

2.<br />

a.<br />

b.<br />

c.<br />

d.<br />

e.<br />

f.<br />

g.<br />

h.<br />

3.<br />

a.<br />

b.<br />

c.<br />

d.<br />

e.<br />

b) For Supply + Site Work<br />

Comprehensive Insurance (Transit/Marine-cum-storage-cumerection<br />

till handing over of equipment) has been taken care<br />

by the Seller & charges of the same have been included in<br />

the quoted prices.<br />

Excise Duty applicable extra on Finished Goods:<br />

Specify Excise Tariff Sub-Heading No.<br />

Present Rate of Excise Duty & Edu. Cess payable extra on<br />

finished goods (including Spares)<br />

Any variations in Excise Duty & Edu. Cess at the time of<br />

supplies for any reasons including variation due to Turnover<br />

shall be borne by the Seller. Only Statutory Variations within<br />

the Contractual Delivery / completion period shall be borne by<br />

Purchaser.<br />

If Excise Duty & Edu. Cess is not applicable at present due to<br />

any reason, the same shall be borne by Seller if it becomes<br />

applicable later.<br />

Confirm Excise Duty & Edu. Cess will not be applicable on<br />

transportation charges.<br />

If Excise Duty & Edu. Cess is not applicable on transportation<br />

charges presently, and if it becomes applicable at the time of<br />

delivery due to any reasons other than statutory, the same will<br />

be borne by the Supplier. Confirm acceptance.<br />

Non Cenvatable Excise Duty, if any is included in quoted<br />

prices & no variation on any account (including statutory<br />

variation) shall be paid by Owner.<br />

Only Statutory Variations, if any, in the present rate of Excise<br />

Duty, upto the Contractual Delivery Date / Completion Period<br />

shall be to Owner’s account subject to documentary evidence<br />

to be furnished by Seller.<br />

Sales Tax applicable extra on finished goods:<br />

Central Sales Tax against Concessional Form “C” payable<br />

extra on finished goods (including spares) is applicable & the<br />

present rate (in %age) is indicated<br />

Kerala VAT payable extra on finished goods (including<br />

spares) without concessional form is applicable & the present<br />

rate (in %age) is indicated<br />

If CST / Kerala VAT is not applicable at present due to any<br />

reason, the same shall be borne by Supplier if it becomes<br />

applicable later.<br />

Confirm CST/ Kerala VAT will not be applicable on<br />

transportation charges.<br />

If CST / Kerala VAT is not applicable on transportation<br />

charges presently, and if it becomes applicable at the time of<br />

delivery due to any reasons other than statutory, the same will<br />

be borne by the Supplier. Confirm acceptance.<br />

Confirmed<br />

_________________<br />

………..%<br />

Confirmed<br />

Confirmed<br />

Confirmed<br />

Confirmed<br />

Confirmed<br />

Confirmed<br />

(Applicable / Not Applicable)<br />

(Please tick whichever is applicable)<br />

…………%<br />

(Applicable / Not Applicable)<br />

(Please tick whichever is applicable)<br />

………….%<br />

Confirmed<br />

Confirmed<br />

Confirmed<br />

SUPPLIER’S SIGNATURE WITH STAMP/SEAL<br />

Page 13 of 291