A1A - EIL Tender portal

A1A - EIL Tender portal

A1A - EIL Tender portal

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

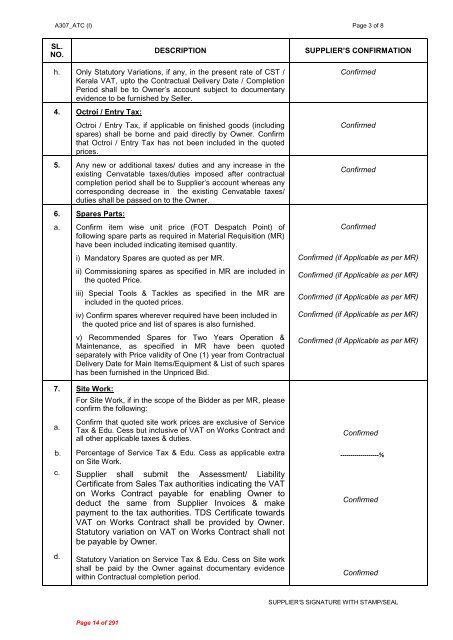

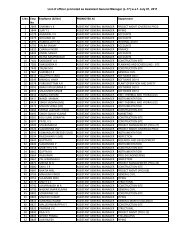

A307_ATC (I) Page 3 of 8<br />

SL.<br />

NO.<br />

DESCRIPTION<br />

SUPPLIER’S CONFIRMATION<br />

h. Only Statutory Variations, if any, in the present rate of CST /<br />

Kerala VAT, upto the Contractual Delivery Date / Completion<br />

Period shall be to Owner’s account subject to documentary<br />

evidence to be furnished by Seller.<br />

4. Octroi / Entry Tax:<br />

Octroi / Entry Tax, if applicable on finished goods (including<br />

spares) shall be borne and paid directly by Owner. Confirm<br />

that Octroi / Entry Tax has not been included in the quoted<br />

prices.<br />

5. Any new or additional taxes/ duties and any increase in the<br />

existing Cenvatable taxes/duties imposed after contractual<br />

completion period shall be to Supplier’s account whereas any<br />

corresponding decrease in the existing Cenvatable taxes/<br />

duties shall be passed on to the Owner.<br />

6.<br />

a.<br />

Spares Parts:<br />

Confirm item wise unit price (FOT Despatch Point) of<br />

following spare parts as required in Material Requisition (MR)<br />

have been included indicating itemised quantity.<br />

i) Mandatory Spares are quoted as per MR.<br />

ii) Commissioning spares as specified in MR are included in<br />

the quoted Price.<br />

iii) Special Tools & Tackles as specified in the MR are<br />

included in the quoted prices.<br />

iv) Confirm spares wherever required have been included in<br />

the quoted price and list of spares is also furnished.<br />

v) Recommended Spares for Two Years Operation &<br />

Maintenance, as specified in MR have been quoted<br />

separately with Price validity of One (1) year from Contractual<br />

Delivery Date for Main Items/Equipment & List of such spares<br />

has been furnished in the Unpriced Bid.<br />

Confirmed<br />

Confirmed<br />

Confirmed<br />

Confirmed<br />

Confirmed (if Applicable as per MR)<br />

Confirmed (if Applicable as per MR)<br />

Confirmed (if Applicable as per MR)<br />

Confirmed (if Applicable as per MR)<br />

Confirmed (if Applicable as per MR)<br />

7.<br />

a.<br />

b.<br />

c.<br />

d.<br />

Site Work:<br />

For Site Work, if in the scope of the Bidder as per MR, please<br />

confirm the following:<br />

Confirm that quoted site work prices are exclusive of Service<br />

Tax & Edu. Cess but inclusive of VAT on Works Contract and<br />

all other applicable taxes & duties.<br />

Percentage of Service Tax & Edu. Cess as applicable extra<br />

on Site Work.<br />

Supplier shall submit the Assessment/ Liability<br />

Certificate from Sales Tax authorities indicating the VAT<br />

on Works Contract payable for enabling Owner to<br />

deduct the same from Supplier Invoices & make<br />

payment to the tax authorities. TDS Certificate towards<br />

VAT on Works Contract shall be provided by Owner.<br />

Statutory variation on VAT on Works Contract shall not<br />

be payable by Owner.<br />

Statutory Variation on Service Tax & Edu. Cess on Site work<br />

shall be paid by the Owner against documentary evidence<br />

within Contractual completion period.<br />

Confirmed<br />

-------------------%<br />

Confirmed<br />

Confirmed<br />

SUPPLIER’S SIGNATURE WITH STAMP/SEAL<br />

Page 14 of 291